Total cost of ownership is the sum of the purchase price of an asset plus operating costs for its lifetime.

A simple example would be the cost of owning a car. You can buy a car, but you will still need to pay license fees and insurance premiums, and it must regularly be serviced. You also need to fill the tank up with gas, and when things go wrong, you have to pay for repairs.

Businesses use total cost of ownership (TCO) when evaluating capital investment. If they want to purchase this new machine or that software package, they will want to know more than just the listed price. It’s logical that they should. Just as a car won’t go without gas and can’t be on the road without a license and insurance, an asset is useless if the running costs can’t be covered or don’t offer sufficient benefits for the price.

Total Cost of Ownership: IT Products

Although the concept of total cost of ownership has been around since the early twentieth century, it was popularized by the Gartner Group during the eighties. It is particularly relevant in information technology deployment decisions.

The deployment of new technologies or systems can cost businesses a great deal of money. When they consider buying a new computer system or software package, they consider TCO in order to determine whether the improvements offered will outweigh the expense incurred.

Let’s look at the factors that would be considered when new hardware and software are under consideration. What are the costs?

- Hardware and software to build the network

- Hardware and software needed to set up servers

- Hardware and software for individual work stations

- Cost of installing and integrating all these components

- Migration costs

- Any license fees to be paid

This list only covers getting the new system up and running, but there will be additional costs:

- What are the financial implications of glitches or failures?

- How often will the hardware or software be upgraded, and what would that cost?

- If support is needed, will it be available, and what costs would this incur?

Now that we have looked at the direct and obvious costs, the list of costs is still not complete:

- How much is the space the new system takes up worth?

- How will this affect utility costs? For example, cooling a complex server can be extremely expensive.

- If backup power systems have to be installed and maintained, what would they cost?

- What cyber security measures must be in place, what will they cost, and what are the cost implications of failure?

- Data must be backed up, and if there is a failure, it should be recoverable. This also has a price tag.

- Managers and staff must be trained to use the new systems. How costly will user adoption be?

- The new equipment must be insured. What will the premiums be?

- Will additional personnel be needed to support the new system?

Finally, we may believe we have reached the bottom line, but that’s not so.

- What if we want to upgrade or upscale?

- Eventually, we would have to replace the system, what is the projected replacement cost?

- When we decommission the system, what costs will we incur?

Now, we will compare the total of all these costs with the running cost of existing systems or other systems we are considering. We may have to factor in a few extras here. For instance, if we are moving from manual invoicing to software-generated invoices, how much does manual invoicing cost us in labor? This includes the time needed for a bookkeeper to enter the invoices into the company’s accounts and the time needed to correct any errors.

Outsourcing may look like an easier solution

The trend towards outsourcing overcomes many of the unknowns companies face when performing a TCO analysis. For example, we can work in the cloud instead of having a physical server in-house. Cloud providers will usually give us a fixed monthly cost that includes some basic support. We still have a complex calculation to do in order to calculate total cost of ownership, but many of the factors we would ordinarily have to account for have been eliminated.

The same is true of software. Whereas we previously purchased software outright and continued to use it until it was outdated, most software providers have moved towards subscription services. Thus, every time we renew our licenses, we will get the latest version of the software as part of the deal. Since subscription service providers are eager to see us renewing our licenses or continuing as subscribers, they usually offer a suite of additional services that companies would have had to pay for in the past.

Nevertheless, subscription services and service level agreements only simplify the total cost analysis. They do not completely eliminate the need for it. They also imply a very thorough investigation of the service provider.

For example, cloud data services can save us a fortune in hardware, but what happens if that server goes down? What is our prospective service provider’s track record like? Does it have very little downtime and a rapid response time when issues arise? How strong is its cyber-security? Does it back up our data? Does it offer support?

Before we can cross anything off the list of cost factors that go into total cost of ownership, we need to know whether we really are covered.

Factors that Reduce the Total Cost of Subscription Ownership

Ultimately, companies need to take risks whenever they seek improvement. The greater the risk, the higher the potential cost of ownership. No matter how wonderful a new subscription service may look on the surface, we need to do a little fact-checking:

- Ask for downtime facts and figures. You don’t want everything grinding to a halt possibly for days or even weeks.

- Can you get live support, and if so, can you get it 24/7? If your business is busy with an important transaction on Saturday morning, waiting for Monday to get support if needed is out of the question.

- Are upgrades and patches free, and will you need to do any re-installation or shutdowns to accommodate these? If so, how long should you expect this to take?

- How user-friendly is the interface? The simpler it is, the less training and orientation will cost.

- Does the provider offer training, or does this come at an additional cost?

- Is the system scalable? If you want to increase or decrease the number of users, what are the cost implications?

- Most important of all, will this new subscription really make your business run more efficiently? If processes only take longer than they did before without an added benefit, it isn’t worth considering.

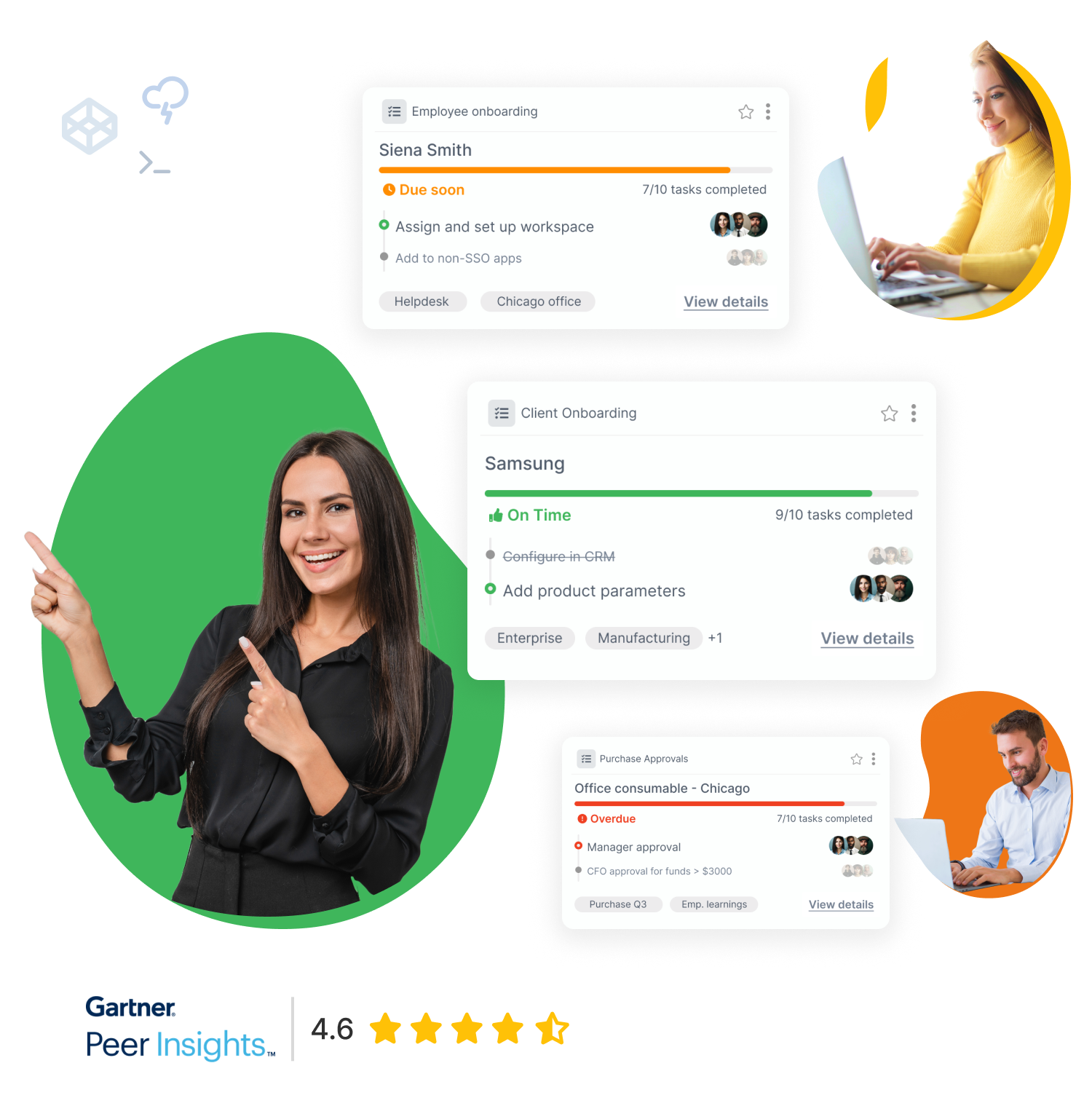

Tallyfy – Use Cloud SaaS to Reduce Total Cost of Ownership

Tallyfy is a workflow engine that has been designed with improving efficiencies firmly in mind. We’re confident that you’ll find little to no risk inherent in adopting our service. On the contrary, the benefits will be far-reaching. Agile businesses live in a world of constant change, adapting constantly. If anything, Tallyfy should reduce the cost of these changes, making them easier and cheaper to implement. But don’t take our word for it – get your free trial and see for yourself!