The Ansoff Matrix is a strategic planning tool used to analyze and generate four alternative directions for business growth.

It helps executives and managers weigh the risks and potential of market penetration, product development, market development and diversification strategies.

The tool provides a visual framework to assess growth options in relation to existing or new products and markets.

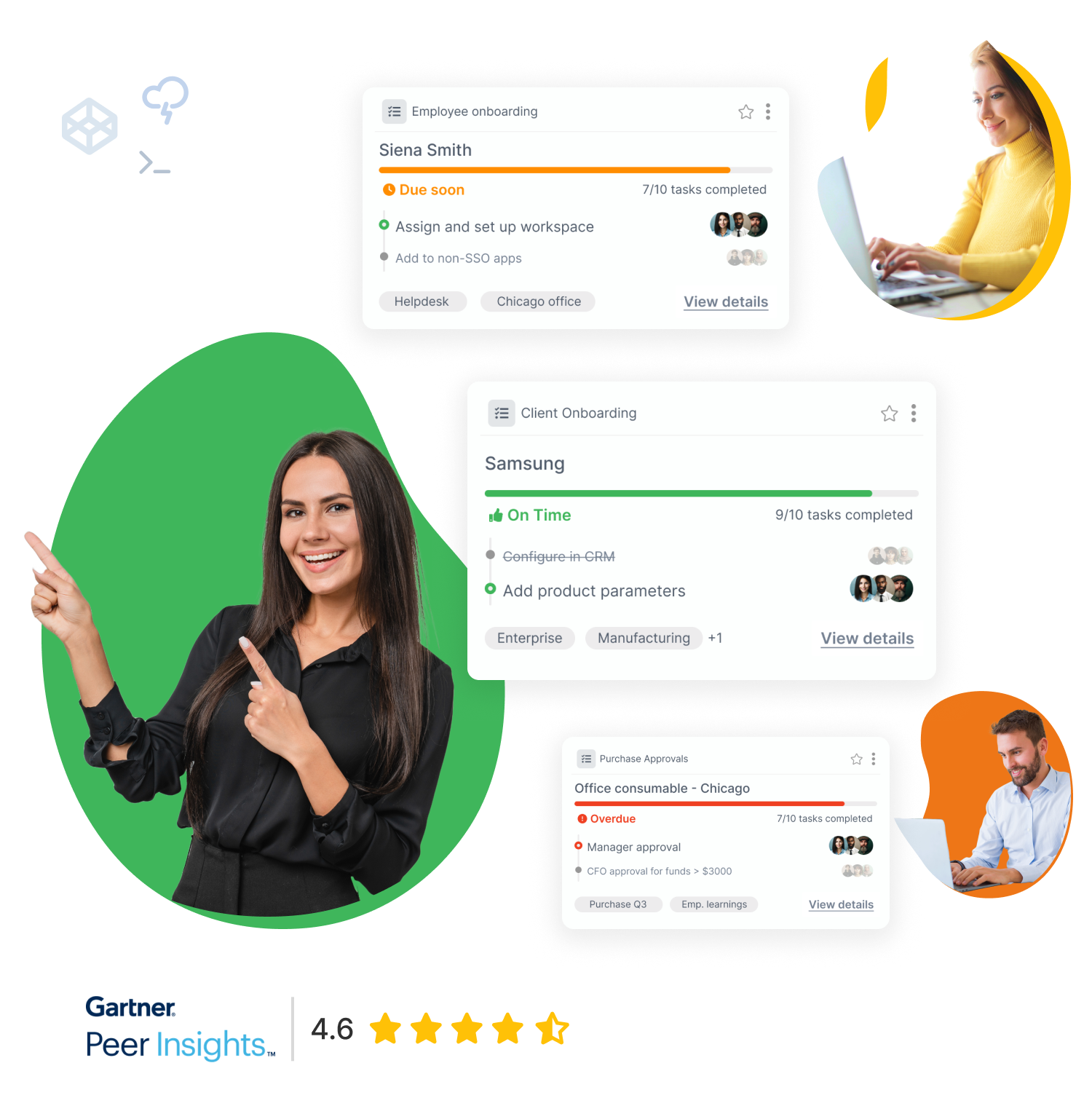

Learn about how Tallyfy’s real-time tracking helps you monitor the progress and status of your growth strategy initiatives.

Who is this article for?

- Corporations and businesses looking to analyze strategic growth options

- Startups evaluating product-market fit and expansion opportunities

- Non-profit organizations considering new programs or services to fulfill their mission

- Educational institutions exploring new course offerings or target student markets

- CEOs, executives, and senior managers responsible for strategic planning and business development

- Product managers and marketers assessing innovation and go-to-market strategies

- Entrepreneurs validating business ideas and planning for growth

The Ansoff Matrix is a valuable tool for any organization or individual involved in strategic decision-making related to growth through new or existing products and markets.

What is the Ansoff Matrix?

The Ansoff Matrix, also known as the Product/Market Expansion Grid, is a strategic planning tool that provides a framework to help executives, managers, and marketers devise strategies for future growth. It presents four possible approaches:

- Market Penetration – Selling more of your existing products to your existing markets

- Product Development – Developing new products for your existing markets

- Market Development – Finding new markets for your existing products

- Diversification – Developing new products for entirely new markets

The matrix helps analyze the risks associated with each option. In general, risk increases each time you move into a new quadrant, with diversification being the riskiest approach.

Quote

The Ansoff Matrix is probably one of the most widespread tools managers use in strategic planning for most organizations. It is easy to understand and allows decision-makers to visually represent the organization’s scope of work.

Applying the Ansoff Matrix

To use the Ansoff Matrix, start by understanding your current position – your existing products and markets. Then plot the potential avenues for growth on the matrix.

Market Penetration

With a market penetration strategy, the aim is to increase sales of existing products to existing customers. This is considered the safest of the four options.

Approaches may include:

- Increasing market share through new sales and marketing initiatives

- Acquiring competitors in the same market

- Increasing product usage through loyalty schemes or sales promotions

- Adjusting pricing to attract more customers

Tip

Use Tallyfy’s structured intake forms to capture leads and opportunities to increase sales within your existing customer base.

Product Development

A product development strategy involves creating new products to serve existing markets. This approach may be appropriate when:

- Your market is saturated and there are limited opportunities for growth

- You have a deep understanding of your customers’ needs and have identified gaps

- You have the resources and capabilities to research and develop new offerings

While less risky than diversification, product development still requires investments and carries the risk of new product failure.

Fact

According to Harvard Business Review, about 75% of consumer packaged goods and retail products fail to earn even $7.5 million during their first year.

Market Development

Market development focuses on finding and pursuing new markets for existing products. Strategies may include:

- Expanding sales into a new region or country

- Targeting a different customer segment

- Adopting new sales channels, such as online or via distributors

Success requires a solid understanding of the new market’s characteristics, competitors, and potential barriers to entry. Modifying products may be necessary to meet the market’s specific needs.

Diversification

Diversification is the riskiest strategy, involving development of new products for new markets. Businesses may pursue diversification when there is saturation or decline in current markets or when seeking higher growth opportunities.

Diversification can be:

- Related – leveraging existing capabilities or resources to expand into a new market or product line. For example, a car manufacturer producing motorcycles.

- Unrelated – entering an entirely new market or industry outside of the business’s current capabilities and value chain. For example, a furniture company launching a line of beauty products.

Careful research and planning is critical with diversification to ensure the business has or can acquire the necessary competencies to compete in the new space.

Fact

Diversification has been shown to hurt financial performance when expanding into unrelated areas. A study of diversification across 40 industries found that businesses with related diversification outperformed those with unrelated diversification (Gary, 2005).

Assessing and Managing Risk

After mapping out growth options using the Ansoff Matrix, the next step is to assess the risk-reward profile of each approach. Executives can then devise risk mitigation strategies for the chosen path.

Yin (2016) proposed combining the Ansoff Matrix with the Analytic Hierarchy Process (AHP) as a new method for scientifically and reasonably analyzing enterprise diversification strategy. The AHP helps determine the relative importance of decision criteria through pairwise comparisons.

Ultimately, the Ansoff Matrix provides a starting framework for evaluating growth strategies, but should be used in conjunction with other strategic planning and risk management tools.

Quote – David Christopher Castillo

Tallyfy is absolutely amazing. It’s perfect for medium to large businesses. They also assure you that they have setup data and security measures which makes it perfect for medium to large businesses as well. 5 stars, no questions asked.

Senior Business Analyst – Voyager. See more quotes

Risks and Warnings

- Failing to fully research and understand new markets before entry

- Underestimating resources and capabilities needed to successfully develop new products

- Pursuing growth in unrelated areas that do not align with core competencies

- Overestimating market potential and demand for new offerings

- Focusing too heavily on diversification while neglecting core business

- Not adapting products to meet the unique needs of new customer segments

- Lacking a clear, long-term strategic vision for growth initiatives

How Tallyfy Supports Strategic Growth Initiatives

Tallyfy’s workflow management software helps organizations successfully plan and implement their growth strategies developed using the Ansoff Matrix:

- Standardize and scale processes: As you expand into new markets and launch new products, Tallyfy allows you to document processes once and roll them out consistently across teams and locations, reducing risk.

- Streamline new product development: Collaborate across departments and track progress from ideation to launch with Tallyfy’s real-time tracking and dashboards.

- Coordinate market entry: Use Tallyfy to align teams and manage the complex set of tasks involved in entering a new market, from research to sales and distribution.

- Optimize and adapt: Tallyfy’s process analytics help you identify bottlenecks and inefficiencies as you scale, so you can continuously improve your growth initiatives.

No matter which quadrant of the Ansoff Matrix you are focusing on, Tallyfy gives you the clarity and control to implement your strategy effectively.

Quote

The Ansoff Matrix is a simple yet powerful tool for any business leader navigating the complex decisions involved in driving organizational growth.

What is the Ansoff Matrix and How Can it Help Your Business Grow?

The Ansoff Matrix is a powerful tool for strategic business planning, particularly when it comes to growing your business in new and innovative ways. Developed by Igor Ansoff in 1957, this framework helps companies analyze and plan their product and market growth strategies.

At its core, the Ansoff Matrix presents four different growth strategies: market penetration, product development, market development, and diversification. By examining your current and potential products and markets, you can use the matrix to identify the best opportunities for growth.

Market penetration involves increasing sales of your existing products to your current market. Product development is about creating new products to serve your existing market. Market development means finding new markets for your current products. And diversification is the riskiest strategy, as it involves developing new products for entirely new markets (Wikipedia).

Fact

A study found that using the Ansoff Matrix in conjunction with the Analytic Hierarchy Process (AHP) can help companies like China’s Evergrande Group to scientifically and reasonably analyze their diversification strategies (Yin, 2016).

How Can the Ansoff Matrix Be Applied to Different Industries?

The beauty of the Ansoff Matrix is its versatility – it can be applied to virtually any industry. For example, in the food industry, the matrix can be combined with artificial intelligence to predict the success of new product development and select the proper market-product strategy (Soltani-Fesaghandis & Pooya, 2018).

In healthcare, the UK’s National Health Service has used the Ansoff Matrix and SWOT analysis to determine how existing skills and resources can be leveraged for future growth, given external market changes (Bennett, 1994). Even in a tough economy, executives across industries can use the matrix to identify growth opportunities beyond just cost-cutting (Johannesson, 2011).

How Might Future Technologies Impact the Ansoff Matrix?

As new technologies continue to emerge and disrupt traditional business models, the Ansoff Matrix will need to evolve as well. For example, the rise of big data and advanced analytics may enable companies to identify new market opportunities and customer needs more quickly and accurately than ever before.

Artificial intelligence could also be used to optimize product development and predict market trends, allowing businesses to stay ahead of the curve. And as consumers become increasingly digitally connected, companies may need to rethink their market development strategies to reach and engage customers through new channels.

At the same time, technologies like 3D printing and robotics could open up entirely new possibilities for product innovation and customization, potentially disrupting existing market dynamics. Companies will need to be agile and adaptable in their strategic planning to capitalize on these opportunities.

Ultimately, while the core principles of the Ansoff Matrix are likely to remain relevant, the specific tactics and technologies used to implement growth strategies will continue to evolve. By staying attuned to technological advancements and maintaining a customer-centric approach, businesses can position themselves for sustainable growth in the years ahead.

Tallyfy Tango – A cheerful and alternative take

Meet Anita and Max, two ambitious entrepreneurs who are always on the lookout for new ways to grow their business. One day, they stumble upon the concept of the Ansoff Matrix and decide to explore its potential.

Anita: Max, have you heard about the Ansoff Matrix? It sounds like a secret weapon for business growth!

Max: (raises an eyebrow) The Ansoff Matrix? Is that some kind of spy gadget?

Anita: (laughs) No, silly! It’s a strategic planning tool that helps businesses decide how to grow. It’s like a GPS for your company’s future.

Max: (intrigued) Okay, you’ve got my attention. How does it work?

Anita: Well, it’s a 2×2 grid that looks at two factors: products and markets. You can either sell existing products to existing markets, new products to existing markets, existing products to new markets, or new products to new markets.

Max: (scratches head) Hmm, so it’s like playing a game of business bingo?

Anita: (chuckles) In a way, yes! But each option comes with different levels of risk and potential reward. It’s up to us to decide which strategy aligns best with our goals and resources.

Max: (rubs hands together) I like the sound of that. Let’s dive in and see where the Ansoff Matrix takes us!

Anita: (smiles) Absolutely! With the Ansoff Matrix as our trusty guide, there’s no limit to how far we can grow our business. Onwards and upwards!

Related Questions

What are the four strategies of the Ansoff Matrix?

The Ansoff Matrix outlines four key strategies for growth: market penetration, market development, product development, and diversification. Market penetration focuses on selling more of your existing products to your current market. Market development involves finding new markets for your existing products. Product development means creating new products for your existing market. Diversification is the riskiest strategy, where you develop new products for entirely new markets.

What are the 4 quadrants of the Ansoff Matrix?

The Ansoff Matrix is divided into four quadrants, each representing a different growth strategy. The bottom-left quadrant is market penetration, which is the least risky option as it involves selling more of your current products to your existing customers. The top-left quadrant is product development, where you create new products for your current market. The bottom-right quadrant is market development, where you find new markets for your existing products. The top-right quadrant is diversification, the riskiest strategy involving new products for new markets.

What is an example of using Ansoff Matrix?

Imagine a bakery that currently sells bread to local consumers. Using the Ansoff Matrix, they could consider four growth strategies. For market penetration, they could offer discounts to encourage existing customers to buy more bread. For product development, they could create new pastries to sell to their current local market. For market development, they could start selling their bread to restaurants or in neighboring towns. For diversification, they could open a completely new business, like a pizza shop, in a different city.

What is Ansoff model used for?

The Ansoff Matrix is a strategic planning tool that helps businesses identify growth opportunities. By looking at the four quadrants of the matrix, companies can assess the potential risks and rewards of different strategies. It encourages businesses to consider whether they can grow by selling more to existing customers, finding new markets, developing new products, or diversifying into new areas. The model helps provide structure to the strategic decision-making process, allowing companies to weigh their options and choose the most appropriate path for growth given their unique circumstances.

References and Editorial Perspectives

Ansoff, H., I. (1980). Strategic Issue Management. Strategic Management Journal, 1, 131 – 148. https://doi.org/10.1002/smj.4250010204

Summary of this study

This paper by Ansoff presents a systematic approach for early identification and fast response to important trends and events that impact a firm. It compares strategic issue management, which responds to signals in “real time”, to periodic strategic planning. The paper provides criteria for choosing between a strong signal and a weak signal strategic issue management system.

Editor perspectives

At Tallyfy, we find Ansoff’s early work on strategic issue management fascinating. It highlights the importance of having systems in place to rapidly identify and respond to changes in the business environment – something that workflow automation can greatly facilitate by providing real-time visibility and agility.

Bennett, A., R. (1994). Business Planning: Can the Health Service Move From Strategy Into Action?. Journal of Management in Medicine, 8, 24 – 33. https://doi.org/10.1108/02689239410059606

Summary of this study

This paper advocates for the use of business planning techniques, specifically the Ansoff Matrix and SWOT analysis, within a National Health Service Trust. It argues that these tools can help NHS trusts determine how to use existing skills and resources as a platform for future growth strategies, in light of external market changes. The paper also explores links between business strategy and management development.

Editor perspectives

The application of classic strategic planning tools like the Ansoff Matrix to public sector organizations is intriguing to us at Tallyfy. Workflow management systems can play a key role in operationalizing strategic plans by aligning day-to-day processes with organizational goals.

Bocken, N., Allwood, J., M., Willey, A., & King, J. (2012). Development of a Tool for Rapidly Assessing the Implementation Difficulty and Emissions Benefits of Innovations. Technovation, 32, 19 – 31. https://doi.org/10.1016/j.technovation.2011.09.005

Summary of this study

This research develops a tool to help consumer goods manufacturers assess potential innovations in terms of their greenhouse gas reduction benefits versus implementation difficulty. The tool uses streamlined LCA to analyze impact reduction potential and a novel measure of implementation difficulty. Results are visualized in a matrix to show trade-offs between options. Initial trials at Unilever demonstrate the tool’s ability to rapidly evaluate low-carbon innovations.

Editor perspectives

We love how this tool provides a practical way to prioritize sustainability initiatives based on both environmental impact and feasibility. At Tallyfy, we believe workflow software can help organizations more seamlessly implement green innovations by embedding new processes into daily operations.

Johannesson, J. (2011). Business Growth in a Tough Economy. International Journal of Business Competition and Growth, 1, 231 – 231. https://doi.org/10.1504/ijbcg.2011.038257

Summary of this study

This paper argues that in a global recession, executives should focus on growth opportunities rather than just cost reduction and restructuring. It addresses concerns with the Ansoff Matrix and proposes an extended version with eight growth vector strategy alternatives that are easier to use for analyzing strategies in a tough economy.

Editor perspectives

The extended Ansoff Matrix presented here offers a more nuanced tool for growth planning that we find compelling at Tallyfy. Workflow automation can enable organizations to efficiently execute on the growth vectors identified, even with limited resources.

Moreno, A., & Casillas, J., C. (2008). Entrepreneurial Orientation and Growth of Smes: A Causal Model. Entrepreneurship Theory and Practice, 32, 507 – 528. https://doi.org/10.1111/j.1540-6520.2008.00238.x

Summary of this study

This study analyzes the relationship between entrepreneurial orientation (EO) and growth in SMEs, rather than just EO and performance as most previous research has done. Using a sample of 434 SMEs and Partial Least Squares modeling, it reveals the complex relationships between EO, strategy, environment, resources and growth.

Editor perspectives

At Tallyfy, we’re fascinated by the interplay of factors that drive SME growth. Workflow management is a powerful tool for entrepreneurial firms to systematize innovation, optimize resource allocation, and scale operations in line with their growth ambitions.

Ramos-Rodríguez, A., R., & Ruíz‐Navarro, J. (2004). Changes in the Intellectual Structure of Strategic Management Research: A Bibliometric Study of the Strategic Management Journal, 1980–2000. Strategic Management Journal, 25, 981 – 1004. https://doi.org/10.1002/smj.397

Summary of this study

This paper uses bibliometric techniques of citation and co-citation analysis to identify the works that have had the greatest impact on strategic management research from 1980-2000, based on articles published in the Strategic Management Journal. It analyzes changes in the intellectual structure of the strategic management discipline over this period.

Editor perspectives

Understanding the evolution of strategic management thinking is crucial context for a workflow software company like Tallyfy. As the discipline has progressed, the importance of dynamic capabilities and agility has come to the fore – areas where workflow automation can provide a real competitive edge.

Soltani-Fesaghandis, G., & Pooya, A. (2018). Design of an Artificial Intelligence System for Predicting Success of New Product Development and Selecting Proper Market-Product Strategy in the Food Industry. The International Food and Agribusiness Management Review, 21, 847 – 864. https://doi.org/10.22434/ifamr2017.0033

Summary of this study

This study designs an AI system to predict new product development success and select appropriate market-product strategies using the Ansoff matrix in Iran’s food industry. Adaptive neural-fuzzy network and fuzzy inference methods are applied to questionnaire data from 250 companies. The system allows CEOs to predict success before developing a new product and consider alternative strategies if needed.

Editor perspectives

We’re excited by the potential of AI to enhance strategic decision-making as demonstrated in this research. At Tallyfy, we believe combining such predictive capabilities with the power of workflow automation could revolutionize new product development processes in many industries.

Suzianti, A., Amaradhanny, R., D., & Fathia, S., N. (2023). Fashion Heritage Future: Factors Influencing Indonesian Millenials and Generation Z’s Interest in Using Traditional Fabrics. Journal of Open Innovation, 9, 100141 – 100141. https://doi.org/10.1016/j.joitmc.2023.100141

Summary of this study

This study aims to increase Gen Y and Z’s interest in using Indonesian traditional fabrics daily. It develops conceptual models using the theory of planned behavior and PLS analysis. Ansoff matrix is used to formulate strategies, and AHP to select priority strategies. The results provide strategic recommendations to optimize traditional fabric usage based on factors influencing each generation’s interest.

Editor perspectives

The multi-method approach used here to analyze a complex, cross-generational marketing challenge is impressive. At Tallyfy, we see workflow automation as a key tool to operationalize strategies like these – ensuring a consistent customer experience across touchpoints.

Waal, G., A., d. (2016). An Extended Conceptual Framework for Product-Market Innovation. International Journal of Innovation Management, 20, 1640008 – 1640008. https://doi.org/10.1142/s1363919616400089

Summary of this study

Recognizing the increasing variety and sophistication of product innovation strategies, this paper presents an extended version of the Ansoff product-market expansion grid. The proposed model has seven categories of growth options, highlighting different approaches for developed and emerging markets. New categories include resource-constrained, necessity, and reverse innovation. Industry examples demonstrate traits of each strategic approach.

Editor perspectives

This extended framework provides a valuable update to a classic strategic tool, reflecting the realities of modern global markets. At Tallyfy, we believe agile workflows are essential to execute these diverse innovation strategies – enabling experimentation while ensuring strategic alignment.

Yin, N. (2016). Application of AHP-Ansoff Matrix Analysis in Business Diversification: The Case of Evergrande Group. MATEC Web of Conferences, 44, 01006 – 01006. https://doi.org/10.1051/matecconf/20164401006

Summary of this study

This paper proposes a new method combining AHP and Ansoff Matrix analysis to scientifically and reasonably analyze enterprise diversification strategy. It applies this AHP-Ansoff Matrix method to the case of Evergrande Group in China. The main procedures of the method are summarized to guide enterprise strategic research practices.

Editor perspectives

The integration of AHP with the Ansoff Matrix here is a great example of how classic frameworks can be adapted with new analytical methods. At Tallyfy, we see huge potential in embedding such strategic decision support tools into workflow management systems to drive real-time, data-driven strategy execution.

Glossary of terms

Ansoff Matrix

A strategic planning tool that provides a framework to help organizations devise strategies for future growth. It is named after Russian-American mathematician and business manager Igor Ansoff, who created the model in 1957. The matrix presents four strategies that organizations can use to grow their business via existing and/or new products, in existing and/or new markets: market penetration, product development, market development and diversification.

Market penetration

A growth strategy where the business focuses on selling existing products into existing markets. It aims to increase market share in current markets through greater marketing efforts, price reductions, or product improvements. This is considered the lowest risk strategy in the Ansoff Matrix.

Product development

A strategy that involves developing new products to sell to existing markets. This strategy may be appropriate if the firm has strong customer loyalty, a successful brand, or deep market knowledge. It carries more risk than market penetration but less than diversification.

Market development

A growth strategy where the company seeks to sell its existing products into new markets. This could involve new geographical areas, new product dimensions or packaging, new distribution channels, or different pricing policies to attract new market segments. Market development has similar risk to product development.

Diversification

The riskiest strategy in the Ansoff Matrix, diversification involves developing new products to sell in new markets. This is an inherently uncertain strategy, as the business is moving into markets in which it has little to no experience with products that are untested. Diversification can be related (building on existing capabilities) or unrelated (moving into entirely new industries).