Getting orders and getting cash both sound like things any business will like, but there’s many a slip between getting an order and actually getting the cash in your bank account. We look at the order to cash process, what it is, ways in which it fails, and the high road for managers hoping to streamline it.

What’s Order to Cash (O2C)?

The order to cash process embraces all the steps and processes that are set into motion when a client places an order, covering everything that your employees will do up to and including the receipt of payment.

Depending on your industry, this can be either extremely simple or complicated. If you operate a retail brick-and-mortar store, the entire process is just the exchange of cash for some item. If, on the other hand, you’re selling an enterprise software, for example, to corporations, the process can be much longer.

O2C processes include order taking, reconciliation of order and inventory, assembling the goods and verifying that this has been done correctly, dispatch and delivery of goods, invoicing, payment and finally, reporting.

The order to cash process thus consists of two distinct subsets of processes: the order management process and the bill-to-cash process.

Why You Need to Care

Back in the day, clients may have been satisfied with long lead times between order placement and delivery, but that’s no longer the case. Whether you are a wholesaler or a retailer working remotely with your clients, the people who buy your goods want fast gratification.

From your perspective, the sooner you get paid, the better. Money tied up in inventory or unpaid, disputed accounts means you experience delayed returns on your investment. Though that might not amount to much if we’re only talking about one or two orders, it can add up to a substantial sum of money when you handle large orders or high order volumes.

Money that you could otherwise invest profitably becomes idle, and if you have to dig into overdrafts to cover cash flow deficits, you should add the cost of credit to the cost of your unproductive cash.

Streamlining the order to cash process makes your clients see you as an efficient business that offers rapid service while literally putting money in your bank account.

The Order Management Process: Pitfalls and Best Practices

How efficient is your order management process? If there are serious problems, you’ll be well aware of them. There’ll be long lead times, calls from dissatisfied clients, an unacceptable volume of shipping errors, and of course, late payments because a flawed order management process usually impacts on the invoicing process. Specific symptoms include:

- Double entry of orders

- Delays between order placement and shipping

- Delivery of orders that don’t match invoices

- Dispatch of incorrect goods owing to misinterpretation of the client’s order

- Poor inventory information that causes sales representatives to turn customers away or take back orders even when the goods are in stock

To streamline this process, you need to look at what’s going wrong. Very often, it’s the result of old-fashioned, manual processes that leave a lot of room for error. Automating processes and linking information such as order placement, inventory and invoicing helps to reduce the volume of errors and allows information to pass from sales to dispatch and on to invoicing without unnecessary delays. Best practices include:

- Minimizing the amount of manual intervention in the process

- Allowing clients to place orders through digital systems

- Integration of information across the process so that workflows progress smoothly

- Elimination of unnecessary complexity in the process

- Providing reps with the information they need to sell effectively. This includes customer information as well as inventory information.

The Bill-to-Cash Process: Pitfalls and Best Practices

Just getting an order placed and sent off to your customer doesn’t mean you’ve been paid yet – especially when you’re working in the wholesaling context. Sometimes, the fault lies with the client who uses your business as an unofficial “bank,” lets the account run to the point of being handed over, and then pays off the principal amount without the interest you’re owed. But that is a subject for another article altogether.

However, if the order to cash process is flawed, many of your unpaid invoices can be laid at its door rather than placing the blame on your customers. After all, we cannot expect clients to pay an invoice when it is incorrect. Signs that your bill-to-cash process needs tweaking include:

- The existence of a large number of unique sales agreements between your company and its clients that specify varying discounts or non-standard payment terms

- Reps clinching deals owing to unauthorized practices and promises

- Mistakes on original quotes and incorrect invoicing

- A large volume of credit notes issued

- Invoices that get sent out late or that are not followed up in good time

- Information gaps between sales, dispatch, and the invoicing process

The strategies you will use to streamline the bill-to-cash process will depend on the problems you pick up when analyzing the process but may include best practices such as:

- Integrating customer profiles into billing software so that it applies the correct payment terms to each invoice

- Integrating invoicing and payment data for easy debtor age analysis and follow-up

- Introducing and following organized workflows to follow up outstanding accounts

- Providing an online platform for clients to communicate with sales and accounts in a single string that begins with order placement and records all subsequent interactions

Streamlining the Order to Cash (O2c) Process

Before you can determine what you need to do, you need to know where the hold-ups are. Spotting these bottlenecks and areas of inefficiency would be difficult without careful tracking of the process. This would include determining the time needed for each step of the process and the identification of ways to reduce that time if possible.

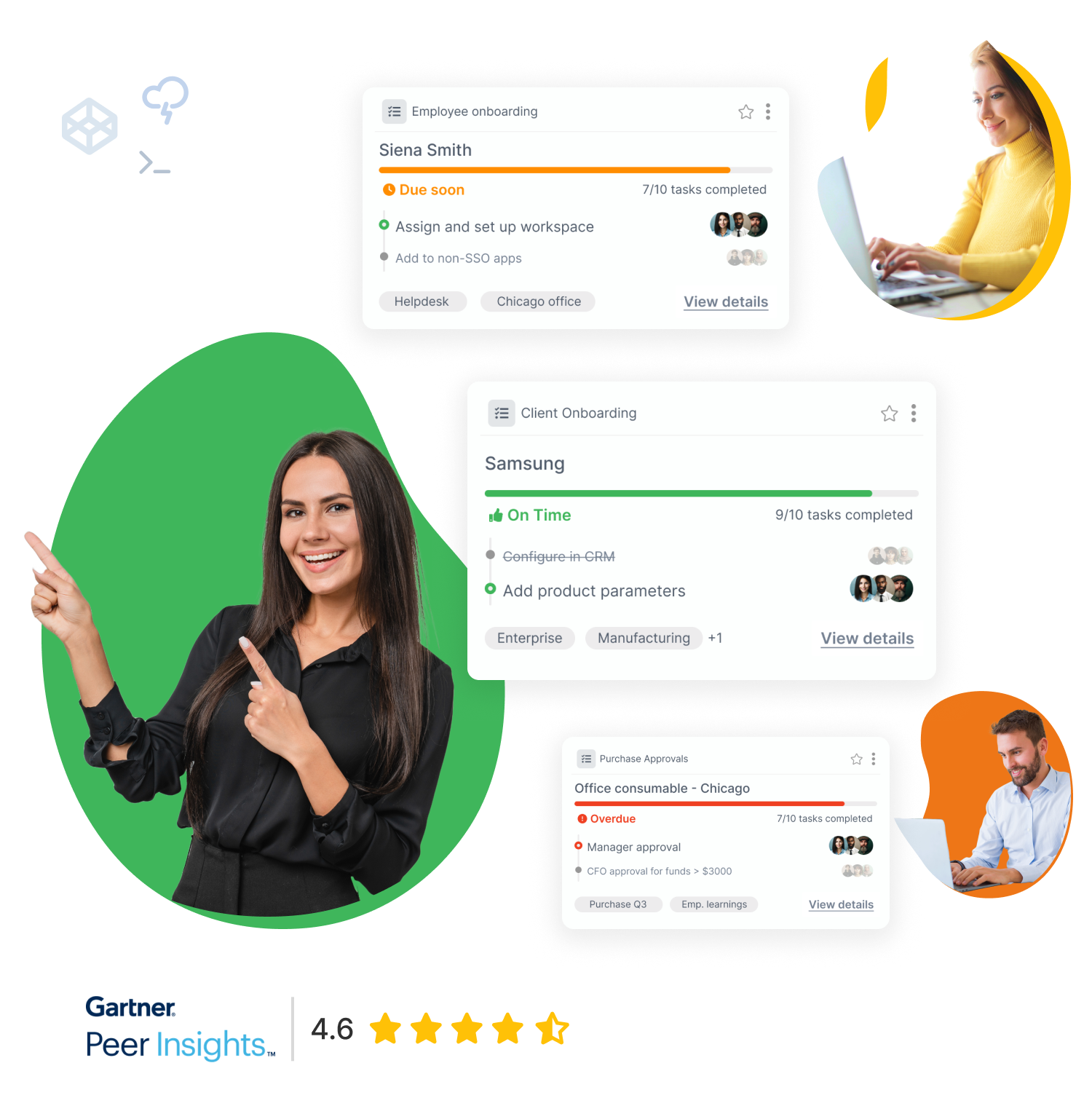

Using workflow software, such as Tallyfy, can make process analysis much easier. The software allows you to keep track of workflows across different departments, allowing you to spot any inconsistencies or bottlenecks. On top of that, the built-in analytics makes it much easier to optimize entire processes for better efficiency.

Finding out more is as easy as getting started. So why don’t you schedule a free demonstration and give Tallyfy a try?