QuickBooks vs Xero: which accounting software is best?

Quickbooks vs Xero are both very popular accounting software. Learn which one is better for your business with our side-by-side comparison!

Whether you choose QuickBooks or Xero, workflow management helps streamline the accounting processes around either platform.

Workflow Made Easy

Summary

- Both target SMBs with nearly identical core features - Cloud-based platforms offering mobile apps, top security, standard reports, customizable chart of accounts, automated bank feeds, and import/export capabilities. The differentiator is how well each executes these features

- QuickBooks dominates with reliability and reporting - Company-owned bank feed service downloads transactions automatically, invoice automation sends on future dates with custom forms and fields, beautiful easy-to-understand reports. Drawback: best features locked in expensive “Plus” version (though still half Xero’s premium price)

- Xero excels at customization and continuous improvement - Free updates every 3-6 weeks, all strong features available in every plan with unlimited users, built-in invoice/bill approval workflow eliminates need for extra software, fine-tuned banking control categorizes transactions into organized spreadsheets, contact groups and customer-specific templates automate invoicing

- Pick based on priorities, not popularity - QuickBooks wins if you need clean intuitive reports and familiar software most employees already know. Xero wins if you prioritize custom invoicing, subscription/rental billing automation, and constantly improving features. Free QuickBooks conversion tool makes switching painless. See how Tallyfy manages business workflows

Almost all companies need to carry out basic tasks such as invoicing, paying wages, dealing with payments, and building accounting reports. Compliance appears in about 1,100 of our customer discussions at Tallyfy, and the right software makes these tasks dramatically easier. Accounting software makes performing these functions easy and efficient. There is, though, a lot of software that does just that! To help make the choices easier for you, we narrowed down the list to two of the best options - QuickBooks vs Xero - and analyzed them based on their pros and cons.

QuickBooks vs Xero - common features

The two companies are close competitors - they both provide a similar set of features aimed at the same audience -small and medium-sized businesses. Both tools cover all the basics of your accounting needs, from payroll to invoicing. In addition, the two share the following similarities:

- Cloud-based

- Easy to use

- Available as iPhone/iPad and Android apps

- Top level security

- Complete set of standard reports

- Customizable chart of accounts (COA)

- Automated bank feeds

- Ability to import/export files

While both tools offer a lot of the same features, the main differentiator is how well each company does these features. So, let’s take a look at what makes each accounting software unique.

QuickBooks

QuickBooks’ Pros

QuickBooks’ Pros

- Apps for Windows and Mac computers

- More widely used

- Company-owned bank feed service

- Invoice automation

- Custom forms and fields

- Easy and beautiful reports

QuickBooks’ Cons

- Must pay for “Plus” version to access many features

- Cannot use or create credits/deposits

- Customers can only view one invoice at a time

- No free trial

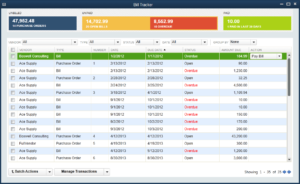

QuickBooks feature review

QuickBooks has dominated the accounting software market for years. It’s intuitive and reliable.

One of QuickBooks’ best features is its own bank feed service. It allows you to easily connect to your bank to download transactions and use other online banking services. The bank feed will record these transactions for you so that you can focus on more important tasks.

When creating invoices, there are many options for automation. You can choose when to send invoices on future dates and set up automated emails for when invoices are sent.

You can also create custom forms with custom fields. You can create multiple different forms to invoice different types of clients.

Another feature QuickBooks excels in is report generation - they are easy to understand and beautifully designed.

Most of the best features of QuickBooks, though, are only available in the most expensive version. On the bright side, it is still half the price of Xero’s premium version.

Who is QuickBooks for?

As mentioned previously, QuickBooks and Xero are marketed toward practically the same type of client. It’s ideal for small to medium-sized businesses looking for a reliable accounting software.

In fact, there’s a good chance that most of your employees - new or old - have had some experience with the software due to its popularity. It’s also fast, easy to learn, and relatively inexpensive.

Xero

Xero’s Pros

Xero’s Pros

- Frequent software updates

- Majority of features available in all plans

- Approval process for invoices and bills

- Free QuickBooks conversion tool

- More control over banking

- More customization options for invoices

Xero’s Cons

- Reports are not as straightforward as Quickbooks’

- Lack of customization of reports

- Below average customer service

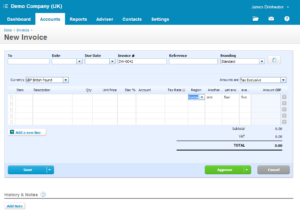

Xero feature review

Xero has not been around for nearly as long as QuickBooks, and accordingly, is not as popular. The platform, though, is very high-tech and ever-updating, with new, free updates coming out every 3-6 weeks.

The software is also very budget-friendly - you don’t have to get the most expensive plan to get all the strong features. In fact, it even offers an unlimited number of users for every one of the plans.

Unlike QuickBooks, you can actually get bills and invoices approved within Xero’s app with a built-in workflow. This takes away the need for even more software/apps.

In addition, the software has fine-tuned control over banking functionality. It will do a better job of categorizing your transactions and even put them in an organized spreadsheet.

While QuickBooks dominates reporting, Xero excels in the customization of invoices. You can create contact groups to fire off invoices more efficiently. You can also create and assign specific templates to specific people so that email and invoice templates are automatically provided for each customer.

If you’re currently using QuickBooks and are looking to switch to Xero, you can simply use the conversion tool - this takes all of your data from one software and transfers it to the other smoothly.

Current pricing comparison

- 1 user

- Income/expense tracking

- Up to 3 users

- Bill management

- Up to 5 users

- Inventory tracking

- Up to 25 users

- Automated workflows

- 20 invoices/month

- 5 bills/month

- Unlimited invoices

- Bulk transactions

- Multi-currency

- Cash flow prediction

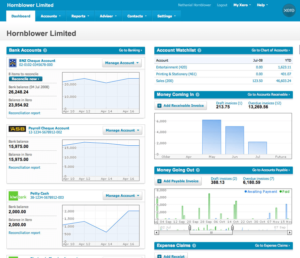

Who is Xero for?

As we have mentioned before, both software is aimed at SMBs. Xero specifically works better with companies that offer subscriptions, rentals or memberships, as the software can automatically perform tasks at set time intervals. In feedback we have received from mortgage and finance teams at Tallyfy, the multi-step approval workflows for loan sign-offs often determine which accounting software they choose - teams processing 40+ loan applications monthly tend to favor whichever tool integrates better with their document management systems.

Their proactive development schedule also ensures that your software will be consistently improving and staying up-to-date. In fact, Xero has quickly become a fierce competitor to QuickBooks after much less time in the industry.

QuickBooks vs Xero - the final verdict

QuickBooks vs Xero come head-to-head when it comes to the best accounting software for SMBs. They share a majority of their features, making the decision between the two difficult.

But there’s not one winner for everyone, so when making your decision take your company’s individual needs into consideration.

Why Pick QuickBooks

QuickBooks is the always-reliable option for accounting software. Almost everyone in business has or still uses it.

The software most dramatically beats out Xero when it comes to reporting, so if your focus is on clean and intuitive reports, then QuickBooks may be the better option for you.

Why Pick Xero

Xero is a relatively new but fierce competitor. It updates constantly. If you value an accounting software that’s consistently updating to give you the best features in the market, then Xero is probably a no-brainer.

Xero’s most distinctive feature, when paralleled with QuickBooks, is its invoice customization. If you find yourself prioritizing automatic and custom invoices over beautiful reports, Xero might be the one for you.

Hopefully, we managed to help you decide which accounting software is the best for your business. Taking both for a test drive is the best way to find your fit.

Automate your accounting workflows

Whichever accounting software you choose, you can streamline and track the processes around invoicing and reconciliation with Tallyfy:

QuickBooks and Xero are trademarks of their respective owners.

About the Author

Amit is the CEO of Tallyfy. He is a workflow expert and specializes in process automation and the next generation of business process management in the post-flowchart age. He has decades of consulting experience in task and workflow automation, continuous improvement (all the flavors) and AI-driven workflows for small and large companies. Amit did a Computer Science degree at the University of Bath and moved from the UK to St. Louis, MO in 2014. He loves watching American robins and their nesting behaviors!

Follow Amit on his website, LinkedIn, Facebook, Reddit, X (Twitter) or YouTube.

Automate your workflows with Tallyfy

Stop chasing status updates. Track and automate your processes in one place.