It’s time to reel in the old definition of disruption and replace it with one that enables enterprises to manage disruptive innovation sustainably. At least, that is the new tack Clayton Christensen promotes.

The key is to embrace disruption and change early. Don’t react to it decades later. You can’t fight innovation.Ryan Kavanaugh

CEO of Relativity Media

Christensen, a Harvard business professor considered the father of the idea of disruptive innovation back in the 1990s, now seeks to rein in tangential or unsustainable interpretations of his theory by honing it down to the question, what is it that causes customers to buy a certain product, or, what is the job to be done?

This question is the focus that makes managing disruptive innovation sustainable. As Christensen says in a recent Washington Post interview:

“Our experience has been that if somebody organizes and conceives and realizes there’s a job to be done, and there isn’t anything you can hire to do the job, that’s the context in which a company can be successfully launched. Furthermore, if you organize your company around a job to be done, it’s very hard for those companies to be disrupted by somebody who comes in at the bottom of the market with something that is just cheaper. It gives you insurance against disruption.”

Here is a look at three examples:

- Management Today cites the story about a developer who thought he was giving his customers the types of homes they were looking for but was unable to close sales until a focus group taught him that the job to be done is to allow them to entertain using their dining rooms. He incorporated larger dining areas and sales followed.

- The Washington Post article cites the well-known example of global retail giant IKEA who defined the job to be done as showcasing for customers what their entire room could look like, disrupting the retail industry’s approach to sales.

- Robin Chase, the founder of Zipcar, offers up Uber as an example of disruptive innovation: “enabling people to drive their own cars as taxis, particularly via its UberX service. The breakthrough lay in tapping excess capacity: downtime from your other means of earning income and making use of the car you already owned.” The job to be done here is, what to do with one’s car when it is sitting idle at home.

Briefly, the three key requirements for managing disruptive innovation successfully over time are:

- Avoiding distractions created by focusing the balance sheet. Instead, focus on the income data.

- Maintaining a focus on identifying the job that the customer needs to have done.

- Tracking and analyzing your current customer interactions—especially onboarding touches—in order to identify opportunities to create disruptive innovation.

Let’s drill down into those, starting with what may be getting in the way of identifying new opportunities for disruption.

Income or balance sheet: which data drive your decision-making?

Every enterprise collects and analyzes data. The savvy executive is the one who can identify which data should drive which decisions.

That brings us to the first key to managing disruptive innovation sustainably: an emphasis on your income statement rather than your balance sheet. Why? While your balance sheet reflects how efficient your operations are relative to income, your income statement reflects whether you are getting the job done for your customers.

In Management Today, Christensen takes on the possibly rogue notion of over-reliance on spreadsheet data, particularly if your goal is creating and managing disruptive innovation. Spreadsheets generate financial ratios that, while they serve certain purposes well—after all, optimizing ROI is a reasonable goal—they also can work to stifle a focus on the job to be done by lending too much weight to balance sheets rather than income.

- As an example, according to Management Today, if you focus on gross margins or ROI ratios, you may tend to make decisions that lead to boosting those numbers, often at the expense of focusing on what job the customer needs to be done.

Christensen outright states that this approach “causes businesses to manage by the balance sheet, rather than the income statement, and they’re not able to innovate.”

- Equally dangerous to sustainability is a focus on the low-end approach to disruption, it appears.

It used to be widely accepted that producing a low-end product for a different market was the job that needed to be done. In How Big Data is changing disruptive innovation – Maxwell Wessel, GM at SAP who runs a business unit pursuing disruptive growth, explains that the low-end approach “wasn’t what was holding incumbent firms captive. It was their own cost structures and their focus on driving marginal profit increases that kept those companies headed down the wrong paths. As long making the right decision on a short-term basis (trying to drive more value out of outdated infrastructure) is the wrong decision on a long-term basis (failing to adopt new technology platforms), CEOs are destined to struggle.”

Focusing on the job that needs to be done

Television’s “Shark Tank” repeatedly provides the lesson that successful entrepreneurs get a specific job done for customers. Once an entrepreneur makes their pitch, one of the sharks invariably asks, what are your sales? Only after the sharks receive data about customer purchases do they ask about pricing and operating costs. No customer purchasing data? Typically, no investment.

- The sharks know that the volume of customer purchases tells the story of whether that entrepreneur identified the right job to be done, and the right job to be done drives the value of that enterprise.

More typical product development approaches are either to build a better mousetrap or to “build it and they will come.” Why is disruption better?

- Building a better mousetrap leaves your enterprise contending with all the competition making mousetraps. Some customers may choose your better one, and some may not—a precarious perch.

- Building a new product and assuming that once you do, the sales will inevitably follow leaves you relying on the assumption that early adopters will endorse your efforts with enthusiasm. You could end up with a housing development and no buyers.

- Focusing on the job to be done is the only surefire approach. As Christensen explains in his Washington Post interview, “Every day, stuff happens to us: Jobs arise in our lives that we need to get done. What causes us to buy products is not our characteristics or attributes, but rather, we find ourselves needing to resolve problems.” He adds, “Every job has a functional and emotional and social dimension to it.”

Given those attributes, what are some ways to define the job to be done?

Maxwell Wessel defines disruptive innovation generally as having three characteristics:

- Cheaper (according to the customer)

- More accessible (in terms of utility or distribution)

- Uses a business model with structural cost advantages (relative to existing solutions).

Wessel argues that since data drive most of our more recent disruptive innovations, “there are new opportunities to attack industries from different angles.” Disruption, he says, means “starting where the source of data is, then building the information enabled system to attack an incumbent industry.” Uber, Netflix, and Google, he notes, have shown us how this works.

- Netflix is the perfect model: it transformed how we view television—creating a wide range of viewing options inexpensive to access and infinitely more easily accessible by being enabled on all our devices. It reduced the need to even own a TV, never mind feel chained to a cable or satellite dish provider.

Wessel suggests that these three new questions replace the three older ones above for executives who seek to identify and manage opportunities for disruption:

- “How can you adapt in the face of this new type of competition?”

- “How do you evaluate new threats?”

- “What capabilities do you need and where do you get them, when data is a critical piece of any new disruption?”

Christensen and Wessel appear to agree on our initial point: a focus solely on short-term gains is likely to stifle an enterprise’s ability to focus on the job that needs to be done.

Data that supports disruptive innovation

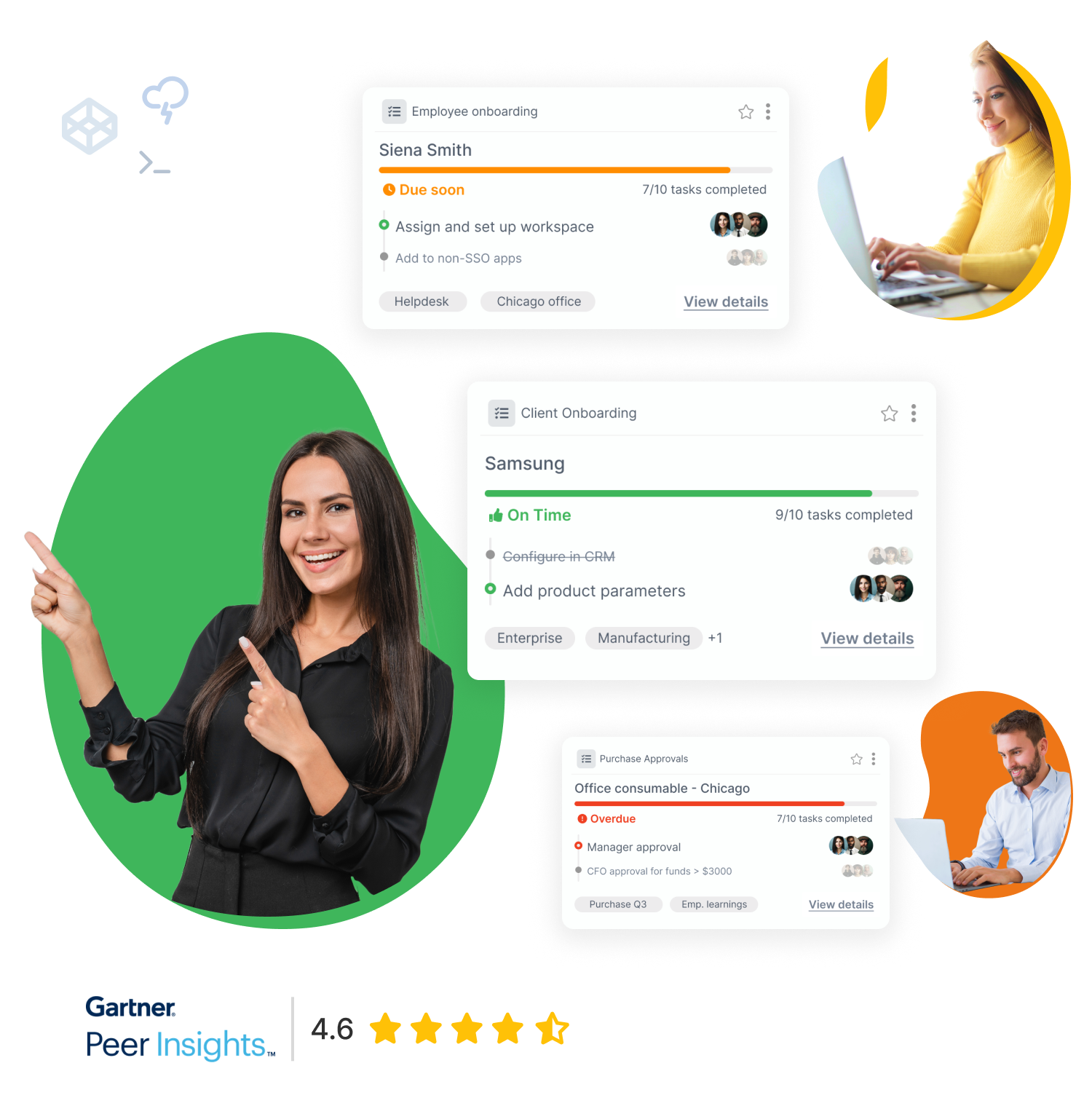

No doubt, tracking your customer communications—onboarding touches in particular—will be critical to both identifying opportunities for disruptive innovation and ensuring that your solutions are the right ones to get the job done for your existing and potential customers.

Vital to the task is ensuring that employees who interface with customers are armed with the tools to identify and segment customer responses in a way that captures their “functional and emotional and social” engagement with your product or service. Those typically are not uncovered in a day or a week, or even a month. It may take time to ferret out the full range of your customers’ reactions and levels of enthusiasm.

Investing in the right software can make all the difference to your company’s complete understanding of your customer’s response. The right tracking software also can enhance teamwork exponentially, and bring about significant improvements in your company’s agility, efficiencies, and levels of innovation related to customer satisfaction.