The legislative environment in which a company operates is one of the external factors that no business can afford to overlook. And even if you’re sure that your business currently complies with the law, or was compliant with it a few months back, laws can and do change. Although you might want to heave a sigh of frustration when you have to embark on regulatory change management processes yet again, you can’t just turn a blind eye.

Is there a way to take the pain out of the regulatory change management process? The answer is “yes.” You will need to make some effort, but you can quickly and irreversibly incorporate changes in reporting obligations, the record-keeping process, health and safety regulations and more.

Let’s take it one step at a time. What does the regulatory change management process consist of? Next, we’ll look at how to track it.

Step 1: Know The “What” of Regulatory Change

Professionals who manage or help you with regulatory compliance in their specialized area should have their fingers on the pulse. It’s not just a matter of knowing what has already changed, but also knowing what’s likely to change in the future.

Reuters and other information agencies run regulatory update news services, and it’s worth subscribing to them to keep an eye on developments. For more specific updates, you can sign up for newsletters from regulatory agencies to keep you in the loop. It’s also a good idea to keep an eye on the news to see high-profile examples of regulatory breaches you’d prefer to avoid.

Once you know that regulatory change affects you, or that you need to beef up on compliance with existing laws, it’s time to understand what you need to do to reduce or eliminate compliance risk.

Reading legal language in order to understand just what new thing you ought to be doing is nobody’s idea of fun. Between convoluted sentences and terminology, it’s often almost impossible to comprehend what the law means. However, the agencies who oversee legal compliance are eager to help.

For example, the IRS website publishes a lot of no-nonsense information that can help you to understand what you’re supposed to do. OSHA offers a free booklet to help small business to comply with health and safety regulations, and so on.

If you still aren’t sure what your revised legal responsibilities entail, you can always contact the relevant agency with your questions. Ideally, you should get their answers in writing rather than over the phone.

Step 2: Determine Where You Need to Implement Change

Now that you know what the change is, it’s time to see how it affects your organization and the way you work. For instance, a lot of regulatory changes affect financial management. That will mean that the people who supply information to your finance department or advisors may need to change their work methods.

If the new legislation affects occupational health and safety or how your HR department works, the chttps://web-cms.tallyfy.com/regulatory-change-management/hange will impact other functional areas of your business too. Follow your organizational structure to see whose work is affected by the new laws.

You will also need to look at your internal processes. Do you need to change day-to-day operations to be compliant with legislation? How does the law affect the business processes you undertake? How will you communicate changes and ensure that your employees implement these changes?

While you’re about it, look for opportunities. Regulatory change doesn’t always need to be a threat. Let’s suppose that the EPA has tightened up emissions laws. If you’re already doing better than the legal requirement, that’s a marketing opportunity you wouldn’t want to miss!

Step 3: Look at How Regulatory Change Impacts Your Business

Compliance has its costs. Deloitte reports that since the financial crisis, the cost of compliance in the banking sector has risen by 60 percent. A substantial increase in compliance costs could have an unwelcome effect on your business’s financial well-being.

For example, if you used a certain chemical in your production processes but may no longer do so, what is the cost of an alternative chemical? Will it affect your production line processes, equipment needs, and materials costs? Will your process take longer to complete, and what will that cost your business?

There are also indirect compliance costs such as the need to send employees for refresher courses or other training.

Needless to say, compliance costs must be factored into financial planning. They may even affect the pricing of your service or product offering. Enter the regulatory change management process knowing how it will affect your costs as well as your activities. Strategize to minimize negative financial impacts.

Step 4: Implement Change

Once you have verified that the actions you mean to take will ensure regulatory compliance, know what to change, how to change it, who is responsible for implementing change, and what it will cost, it’s time to get the ball rolling.

It all starts with informing all the affected parties within your business as to what you plan to change and why it’s important. You need their buy-in, and they may have extra ideas and suggestions you’d like to consider. But you do need to move ahead with the regulatory change management process, so be sure you aren’t getting bogged down.

Work, no matter what work it is, consists of processes and is governed by policies and procedures. Align all three of these elements with the new legislative requirements. But people are accustomed to working in a certain way, and you need to overcome the habits of yesteryear and entrench the new way of working. That means implementing controls, too.

No inspectorate organization in the world is going to accept that you didn’t comply with the law because your employees failed to embrace the changes you made. Your business remains responsible for enforcing regulatory change internally.

However, regulatory change management needn’t be an excessively painful process. You’ve identified whose work methods will change to comply with the new laws. And the key to the regulatory change management process is in the word “process.”

A process is a repeatable way of doing things. Even the thinking and information-gathering you’ve done up till now has involved a process that you can use again when you next face regulatory change. And processes are quite easy to manage if you have the right tools.

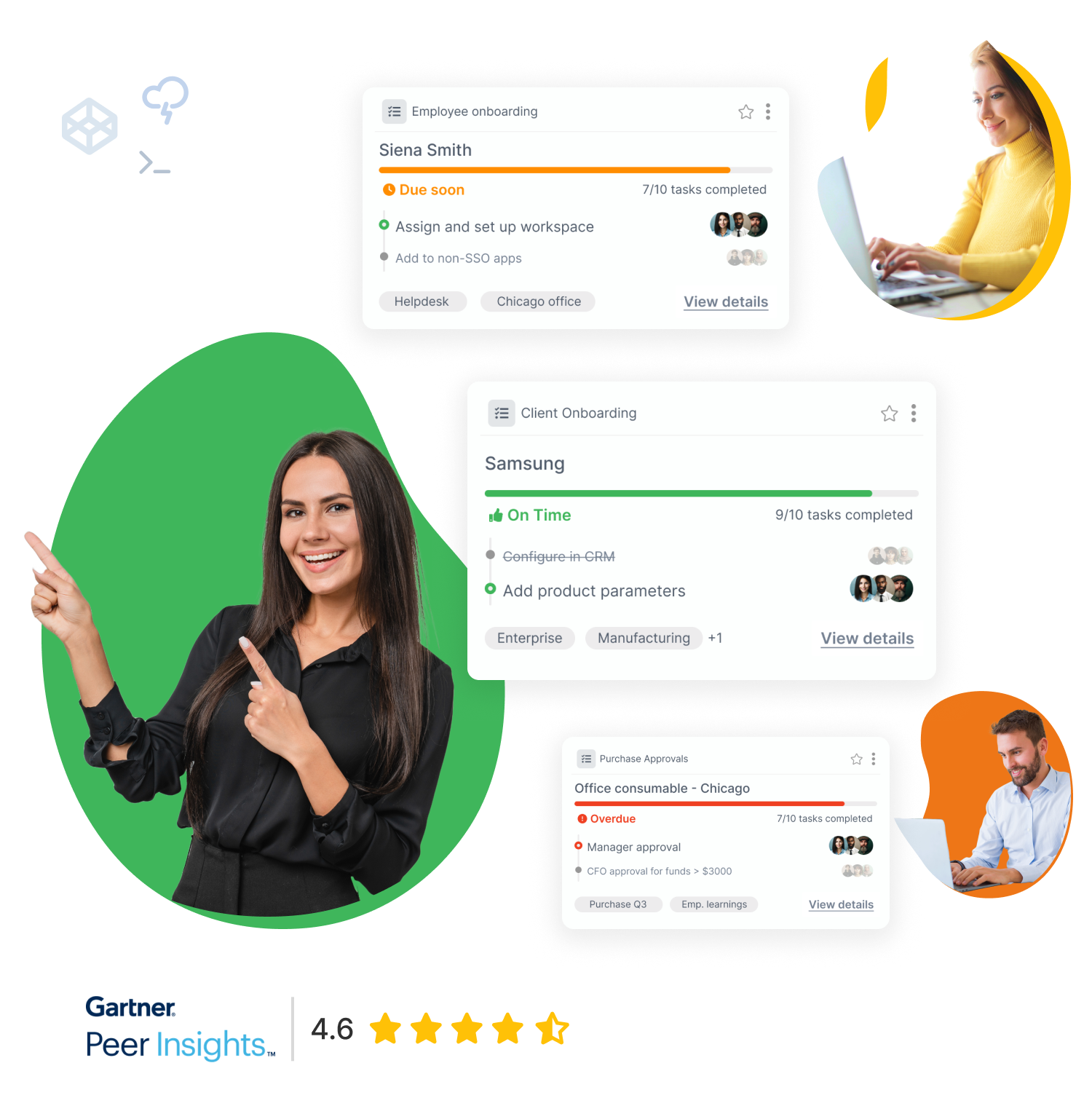

A tool like Tallyfy allows you to allocate tasks, specify standards, policies, and procedures, and implement regulatory change instantly.

An Example of a Regulatory Change Management Process

| What to Do in a Regulatory Change Management Process |

| Monitor the regulatory environment |

| Identify relevant regulatory change |

| Determine who is affected |

| Determine what internal policies govern their work |

| Check for alignment with legal requirements |

| Determine the practical impact of regulatory change on tasks |

| Look for opportunities and threats |

| Determine the cost of regulatory compliance |

| Adapt processes, policies, and procedures (this could include several sub-tasks) |

| Verify that planned adaptations will achieve compliance |

| Communicate with affected employees |

| Provide training as needed |

| Deploy changes to processes and procedures |

| Monitor implementation and reporting |

| Verify evidence of compliance (reports, records, etc.) |

Unless your business is a one-man-band, you can identify the employees best suited to each task, allocate the regulatory change management process’s tasks to those best suited to the job, and make your decisions based on their findings.

There’s no need to call dozens of meetings either. Tracking the regulatory change management process is as easy as setting it up using Tallyfy and then running with it.

Sometimes, face to face contact with your team is necessary, especially if you’re brainstorming ideas or want one-on-one interaction. But the routine tasks involved in the regulatory change management process are just that: a matter of routine that can be implemented and tracked.

Although the players involved in the regulatory change management process and the specifics you’re dealing with may vary depending on who is affected, the basic steps remain the same. Design the process. Delegate. Work as a team. Track the process. It makes everything so much easier.