The essential guide to governance, risk management and compliance (GRC)

Build robust GRC frameworks for your organization without enterprise complexity

Summary

The cost of poor governance is not just financial - it is measured in broken trust, lost opportunities, and careers derailed by preventable disasters.

- MIT Sloan Management Review

- GRC is not about adding bureaucracy - it is about stopping the $37,000 per employee you are hemorrhaging annually from chaotic processes and compliance failures (IDC research)

- Based on feedback from hundreds of operations teams, modern GRC software promises everything but delivers complexity - one global pharmaceutical team processing 1,117+ compliance forms annually found that enterprise platforms required 6-12 months just to implement

- The reality check nobody mentions: Gartner found 73% of companies struggle with GRC adoption because they bought enterprise solutions that overwhelmed their teams - we have seen healthcare teams managing 87,000 policy documents resort to spreadsheets despite having expensive software

- What if you could get the benefits of GRC without the nightmare? Teams using simplified workflow tools report 80% faster compliance documentation and automated audit trails. Schedule a quick chat to see a different approach.

Here is what happened at Target in 2013. One overlooked vendor. One security gap. 110 million customer records stolen. $162 million in losses.

Not because they did not have governance policies. Not because they lacked risk assessments. But because their GRC existed on paper while reality ran wild.

Sound familiar?

You are drowning in spreadsheets tracking risks that nobody updates. Your compliance team sends desperate emails begging for policy acknowledgments. Meanwhile, actual risks multiply in the shadows - untracked, unmanaged, unknown.

Perfect GRC strategy. Zero execution. Welcome to modern business.

McKinsey found that companies waste 28% of their workweek on "work about work" - status updates, compliance tracking, risk documentation that sits untouched. That is not governance. That is theater.

What GRC actually means (without the corporate gibberish)

Forget the acronyms for a second.

Governance = Who decides what, and how

Risk Management = What could go wrong, and what we will do about it

Compliance = Following the rules so we do not get fined into oblivion

Simple, right? Yet somehow we have turned this into a $51.7 billion industry selling complexity.

Think about it. Your business already does these things. You have decision-makers (governance). You avoid stupid risks (risk management). You follow laws (compliance).

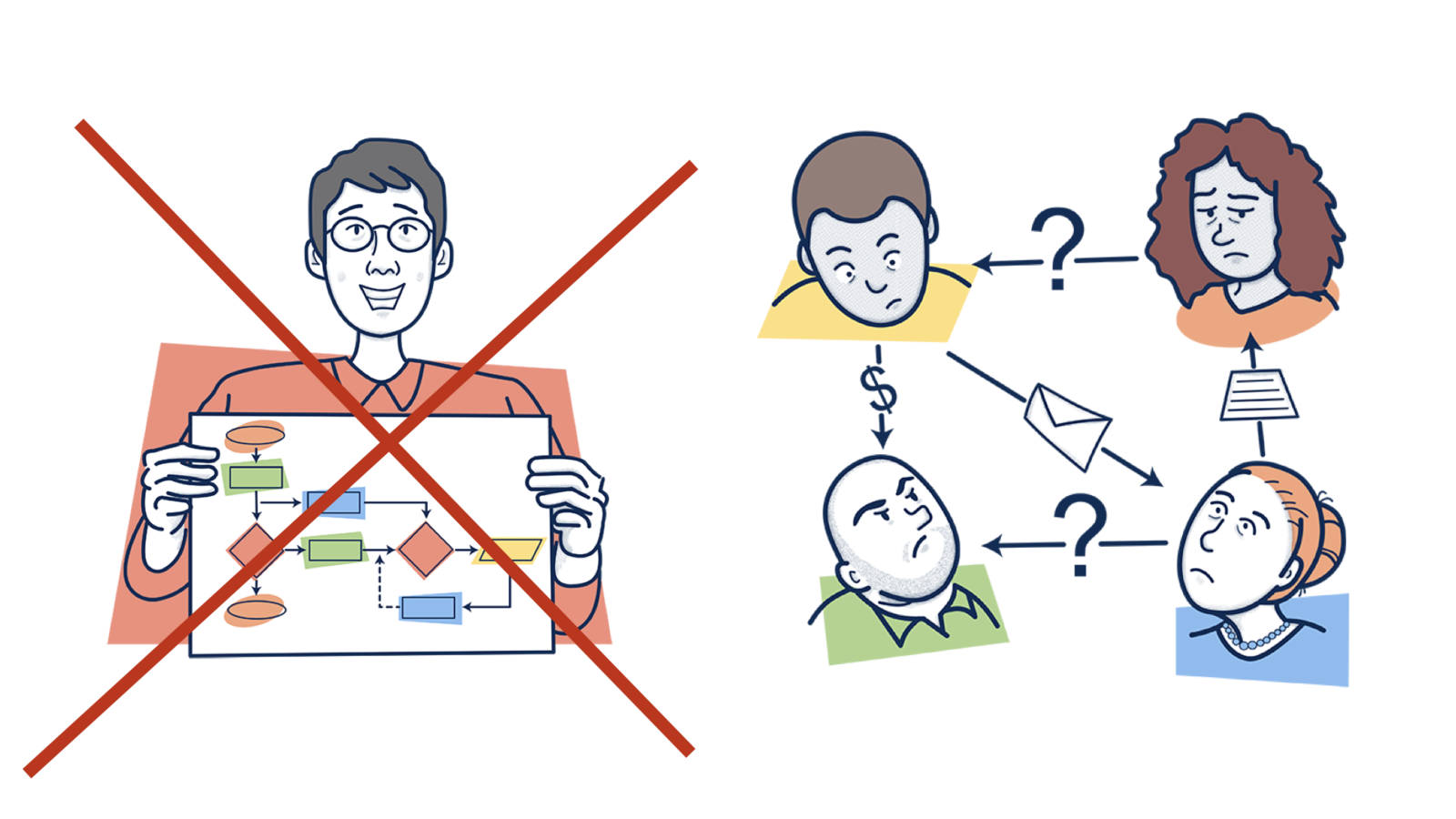

The problem? You are doing them in silos. Finance tracks financial risks. IT manages cyber risks. Legal handles compliance. Nobody talks to each other until something explodes.

GRC is supposed to fix this mess. Connect the dots. Create one source of truth. Make sure the left hand knows what the right hand signed us up for.

Instead, most GRC implementations create new silos - expensive, complicated, software-shaped silos that require consultants to operate.

The uncomfortable truth about GRC benefits

Everyone talks about GRC benefits like they are guaranteed. They are not.

Yes, integrated GRC can cut operational costs by 30% according to Gartner. But here is what they do not mention: that is IF you can get people to actually use it.

The real benefits that matter:

You will stop losing $37,000 per employee annually

IDC research is brutal. Every knowledge worker you employ bleeds $37,000 yearly through inefficient processes. Not productivity losses - actual, measurable waste from duplicate work, failed audits, and compliance scrambles.

In our conversations with mid-size healthcare operations teams, we consistently hear the same story: 200 employees bleeding $7.4 million annually through process inefficiencies alone. One operations team told us they spent $150,000 per year just on extra headcount to handle manual compliance tracking - savings they recovered within months of automating their workflows.

Audits become boring (in the best way)

Remember your last audit? The panic? The overtime? The prayer circle hoping you documented everything?

With functioning GRC, audits become uneventful. Evidence exists. Trails are clear. Auditors get bored. You get home on time.

Feedback we have received from manufacturing operations teams tells the same story: going from 3-week audit prep nightmares to 3-hour report generation. One government contractor running 16 scheduled compliance workflows for ISO 9001 and CMMC certifications told us they completely eliminated manual tracking - PDF audit reports now generate automatically. As one operations director put it: "It is almost disappointing how easy this is now."

Decisions happen at actual speed

No more death by committee. Clear governance means clear authority. Based on hundreds of implementations we have supported, teams typically reduce their average decision time from 12 days to 12 hours. Not because they rushed - because they eliminated the "who decides this?" paralysis.

Your reputation becomes bulletproof

Wells Fargo created 3.5 million fake accounts. Volkswagen faked emissions tests. These were not technology failures. They were GRC failures that destroyed decades of trust in months.

Proper GRC makes these disasters nearly impossible. Not through more rules - through visibility that makes bad behavior obvious before it spreads.

The complete guide to GRC software (and why you might hate all of it)

Let us talk about the elephant in the room. GRC software.

The market is worth $51.7 billion. Hundreds of vendors. Thousands of features. And based on actual user reviews, most of it is a nightmare to use.

Here is the honest breakdown of the top platforms - warts and all:

MetricStream: The "enterprise" trap

What they promise: Complete GRC transformation with AI-powered everything.

What you get: A platform so complex that users report needing full-time administrators just to operate it. The interface looks like it was designed in 2005 because, well, parts of it were.

The investment: Enterprise-level pricing that typically requires significant budget allocation. Implementation, training, and ongoing support add substantial costs beyond initial licensing.

Real user quote from G2: "The learning curve is brutal. After 18 months, we still need consultants for basic changes. It is powerful if you have unlimited budget and patience." - Verified Enterprise User, G2.com

Who it is actually for: Fortune 500 companies with dedicated GRC teams and seven-figure budgets who need to check every regulatory box imaginable.

ServiceNow GRC: Death by a thousand modules

The pitch: GRC that integrates with your IT service management!

The reality: You will need modules for risk, modules for compliance, modules for audit, modules for vendors. Each module costs extra. Each module needs configuration. Each module requires training.

The cost reality: Significant annual investment for mid-market companies. But here is the killer - customers report needing 3-6 months just for basic implementation. One financial services firm invested heavily in consultants alone.

Actual review from Gartner Peer Insights: "Powerful platform buried under overwhelming complexity. Our team essentially gave up and hired ServiceNow experts to run it for us." - IT Director, Gartner

Best case scenario: You already use ServiceNow for everything else and have in-house experts who live and breathe the platform.

IBM OpenPages: Where user interfaces go to die

IBM promise: AI-powered GRC with Watson!

What users experience: An interface that feels like navigating a 1990s mainframe. Even simple tasks require multiple screens, countless clicks, and tribal knowledge passed down through generations of users.

Investment level: Enterprise pricing tier requiring substantial budget commitment. Plus implementation. Plus customization. Plus therapy for your team.

From a verified review: "Comprehensive? Yes. Usable? Barely. We joke that OpenPages is where good UX goes to die. Powerful backend, nightmare frontend." - Risk Manager, TrustRadius

Who survives it: Enterprises with massive IBM commitments who value comprehensive features over user experience.

AuditBoard: The "approachable" option that is not

Their angle: Modern, cloud-based GRC for everyone!

The catch: "Everyone" apparently means companies with significant software budgets. Basic modules require substantial investment. Advanced features and additional modules multiply the costs considerably.

Hidden gotcha from reviews: "Surprise charges when you exceed control testing limits. Our CFO nearly had a heart attack when the invoice arrived." - Compliance Manager, G2

The verdict: Better than the dinosaurs above, but still requires significant investment and commitment most mid-size companies cannot justify.

RSA Archer: Customizable to the point of paralysis

The selling point: Infinitely customizable GRC platform!

The problem: "Infinitely customizable" means "nothing works out of the box." Customers report needing armies of consultants and developers to make Archer do anything useful.

One customer journey: "Year 1: Implementation. Year 2: Customization. Year 3: Training. Year 4: Finally using it. Year 5: Wondering why we did this to ourselves." - Anonymous, Reddit r/cybersecurity

Investment required: Platform cost + massive consulting fees + internal team dedication = financial and emotional bankruptcy.

Why 73% of GRC implementations fail (and how to be in the 27%)

Gartner research is damning. Nearly three-quarters of GRC implementations fail to deliver expected value.

Why?

They buy software, not solutions. An expensive platform means nothing if nobody uses it.

They automate chaos. Broken processes, now digital! Congratulations, you have made things worse faster.

They ignore humans. Your team does not want another system. They want their job to be easier.

The 27% who succeed do three things differently:

1. They start with simple workflows, not enterprise platforms

A regional bank replaced their entire GRC suite with basic compliance workflows. Cost: 95% less. Result: 90% better adoption. Why? Because people could actually understand and use it. We have seen similar patterns in pharmaceutical teams - one global life sciences group needed to manage FDA, GMP, and GLP compliance with digital signatures and multi-factor authentication. Instead of buying a seven-figure platform, they built exactly what they needed through workflow automation.

2. They make work visible, not just documented

Documentation does not equal execution. The successful 27% use tools that show real-time status, automatic tracking, and zero manual updates. Work becomes visible without extra work.

3. They measure behavior change, not feature adoption

Who cares if you are using 100% of your GRC platform features? The question is: Are risks being managed? Is compliance happening? Are decisions faster?

One retail chain measured success by "time from risk identification to mitigation." Dropped from 23 days to 2 days. That is GRC success.

The alternative nobody talks about: Simplified GRC through workflow automation

Here is the thing.

You do not need "GRC software." You need governance, risk management, and compliance to happen. Reliably. Visibly. Without destroying your team will to live.

What if instead of buying a massive platform, you just... automated the actual work?

Imagine:

- Vendor risks assessed automatically through simple forms

- Compliance tasks assigned and tracked without nagging

- Audit trails building themselves in the background

- Governance decisions flowing through clear approval chains

- Everything visible in real-time without manual updates

No consultants. No 18-month implementations. No dedicated GRC team.

Just workflows that enforce GRC naturally. Like tracking tasks across your organization or automating compliance checks.

A healthcare startup achieved SOC 2 compliance in 60 days using this approach. Their secret? They did not implement "GRC." They implemented visibility and accountability through simple workflows.

Cost: Less than they spent on compliance consultants the previous year.

Result: Passed audit with zero findings.

When to run from GRC software (red flags nobody mentions)

Vendor sales calls are theater. Here are the red flags that should send you running:

"Our platform does everything!" - Translation: It does nothing well.

"Implementation is typically 3-6 months" - Translation: 9-18 months if you are lucky.

"Our AI will transform your GRC!" - Translation: We added chatbots and machine learning buzzwords.

"Most customers use consultants for optimization" - Translation: Our software is too complex for mortals.

"Pricing depends on your needs" - Translation: We will charge whatever we think you can afford.

"We are the market leader!" - Translation: We are the most expensive.

If you hear three or more of these, hang up. Your sanity will thank you.

How to implement GRC without losing your mind (or budget)

Oracle and IBM will tell you GRC requires enterprise architecture, dedicated teams, and seven-figure budgets.

Nonsense.

Here is how a 300-person logistics company implemented effective GRC in 90 days:

Face reality first

They mapped every decision point, risk register, and compliance requirement. The result? 247 spreadsheets, 18 different "systems," and nobody owning anything.

The CEO reaction: "Holy s***. No wonder nothing works."

That honesty? That is your foundation.

Pick your worst bleeding wound

Do not boil the ocean. They chose vendor risk management because a supplier breach would kill them. One process. One win. Build from there.

Make it visible and automated

No complex software. They used simple approval workflows that actually tracked things. Vendors got onboarded through forms. Risks got scored automatically. Compliance checks happened without nagging.

Result: 90% reduction in vendor onboarding time. More importantly - they could SEE everything.

Expand what works, kill what does not

Success bred success. Other departments wanted in. Within 90 days, they had integrated risk management, automated compliance tracking, and governance that actually governed.

Total investment: A fraction of what enterprise GRC platforms require.

Real GRC in action: How a 400-person fintech survived their nightmare

Let me tell you about TechFin (name changed, story real).

2023: Rapid growth. 400 employees. Zero real governance structure. Risk management = prayer. Compliance = panic.

Then: Major client demands SOC 2 certification. Timeline: 90 days. Options: Get compliant or lose 40% of revenue.

They called IBM. Quote: Significant investment and 6 months minimum.

They called consultants. Quote: Substantial fees and "probably" 90 days.

Instead, they did something radical. They used simple process templates to create:

- Governance workflows: Who approves what, automatically routed

- Risk assessments: Forms that fed into live dashboards

- Compliance tracking: Tasks that proved completion with evidence

- Audit preparation: One-click reports with full trail documentation

Day 87: Passed SOC 2 audit. Zero findings.

Day 90: Client renewed for 3 years.

Total investment: Minimal compared to enterprise GRC platforms.

The auditor comment: "This is the most organized audit evidence I have seen from a company your size."

They did not buy GRC. They built it through workflow automation.

The GRC maturity model (and why level 5 is a fantasy)

Consultants love maturity models. Five levels from chaos to nirvana.

Here is the truth: Nobody reaches level 5. Even level 4 is mostly fiction.

Here is what actually matters:

Level 1 - Chaos: You are here if risks surprise you, compliance is reactive, and governance means "the CEO decides."

Level 2 - Awareness: You know what your risks are. You track compliance requirements. Decisions follow some process. Congratulations, you are ahead of 40% of companies.

Level 3 - Coordination: Different departments actually talk to each other. Risk information flows. Compliance is proactive. This is the sweet spot for most mid-size companies.

Level 4 - Integration: GRC is embedded in operations. Risks are quantified. Governance is clear. Maybe 10% of companies legitimately achieve this.

Level 5 - Optimization: Predictive risk analytics! AI-powered compliance! Self-improving governance! Yeah... this is vendor fantasy land.

Target level 3. It is achievable, valuable, and will not bankrupt you trying.

The ROI math that actually matters

Forget vendor ROI calculators. Here is real math from real companies:

Before GRC

- Compliance fire drills: 200 hours/month of expensive labor costs

- Failed audits/penalties: Significant to catastrophic financial impact

- Risk blindness losses: Potentially devastating (ask Target)

- Decision delays: 2 weeks average x lost opportunities = incalculable

After Effective GRC

- Compliance effort: 40 hours/month - 80% reduction in effort

- Audit findings: Zero to minimal

- Risk incidents: 70% reduction minimum

- Decision speed: 2 days average

Investment required:

- Enterprise GRC software: Significant to massive annual investment

- OR

- Workflow automation: Minimal investment with rapid ROI

The math is not complicated. The question is whether you want to spend 10X more for complexity you do not need.

How to choose GRC software without losing your sanity (or budget)

Still convinced you need dedicated GRC software? Fine. Here is how to not screw it up:

1. Count your actual users, not your employees

Enterprise vendors price per user but only 5-10% of your employees will actually touch the system. Do not pay for seats you will not use.

2. Demand the real implementation timeline

Vendor says 3 months? Ask for customer references. Real timeline is usually 2-3X longer. If you need results this year, "enterprise-ready" platforms will not deliver.

3. Calculate total cost of ownership (TCO) honestly

- Software licenses: The starting point

- Implementation: Usually 50-100% of year 1 licenses

- Training: 10-20% of licenses annually

- Ongoing support: 20-30% of licenses annually

- Customization: Sky is the limit

- Internal team time: Priceless (literally)

4. Test with your worst process

Do not let vendors show their best demo. Make them model your messiest, most complex process. If they cannot do it live, they cannot do it.

5. Check the escape clause

How hard is it to get your data out? Most vendors lock you in with proprietary formats. If leaving costs more than staying, run.

Your 30-day GRC quickstart

Enough theory. Here is what to actually do:

Start by facing reality

- List every compliance requirement you have

- Document top 10 risks keeping you awake

- Map who actually makes decisions (not org chart fantasy)

- Count how many spreadsheets track this mess

Pick one problem

Do not fix everything. Pick the one issue that would make the biggest difference. Usually it is either:

- Vendor risk management (one breach away from disaster)

- Policy management (nobody knows current versions)

- Audit preparation (annual panic attack)

Build simple automation

No complex software. Use basic workflow tools to:

- Create forms for data collection

- Set up approval chains

- Automate task assignment

- Generate simple reports

Test with friendlies

Find your early adopters. Usually it is the people most frustrated with current chaos. Let them test, complain, and improve the process.

Show value and expand

Demonstrate one clear win. Time saved, risk avoided, audit passed - something tangible. Then expand to the next problem.

Rinse. Repeat. Build momentum.

The truth about continuous improvement in GRC

Every GRC vendor preaches "continuous improvement." Here is what they do not tell you: their platforms make improvement nearly impossible.

Want to change a workflow in MetricStream? Call a consultant. Need a new report in ServiceNow? That will be a change request. Adjust a process in Archer? Hope you know XML.

Real continuous improvement requires agility. The ability to adjust quickly based on what you learn. Enterprise GRC platforms are about as agile as aircraft carriers.

Meanwhile, companies using simple workflow automation iterate daily. A risk assessment form not working? Changed in minutes. Approval chain too slow? Fixed before lunch.

One logistics company made 47 process improvements in their first year using workflow automation. Their previous GRC platform? 3 changes in 2 years, each costing thousands in consulting fees.

That is the difference between GRC that evolves and GRC that calcifies.

We have seen global commercial real estate teams struggling with the same problem - they needed to manage Quality Management System documentation for ISO 9001 compliance, with GxP audit trails, across 80+ countries in 23+ languages. Enterprise platforms quoted multi-year implementations. Simple workflow tools delivered working solutions in weeks. The secret? They stopped trying to solve everything at once and started with one process that actually mattered.

The GRC strategy that actually works

After supporting hundreds of operations teams through GRC implementations, here is what actually works:

Start small. One process. One win. Build from there.

Make it visible. If people cannot see it, it does not exist.

Automate the mundane. Let humans handle exceptions, not routine.

Measure behavior, not compliance. Checking boxes is not the goal. Reducing risk is.

Choose tools people want to use. The best GRC system is the one your team actually uses.

Iterate constantly. Perfect is the enemy of good enough to start.

Most importantly: Do not let perfect compliance destroy good business. GRC should enable your company, not paralyze it.

A different path: GRC without the GRC

What if you did not need "GRC" at all?

What if governance was just clear workflows? Risk management was just visible tracking? Compliance was just automated tasks?

In our conversations with operations leaders across industries, we consistently hear the same realization: they do not need million-dollar platforms to achieve governance, risk management, and compliance. They need clarity, visibility, and automation.

Simple tools that:

- Show who is responsible for what

- Track what is actually happening

- Prove compliance without manual documentation

- Surface risks before they explode

- Speed decisions through clear processes

No consultants. No enterprise architecture. No three-letter acronyms.

Just work that works.

One manufacturing CEO put it perfectly: "We stopped trying to 'do GRC' and started trying to run our business better. Turns out, that is what GRC was supposed to be all along."

Your industry, your GRC reality check

Every industry thinks their GRC needs are special. Most are not.

But here is what actually differs:

Healthcare: Death by documentation

HIPAA alone requires 50+ policies. Add state regulations, Medicare requirements, and clinical protocols. You are drowning in compliance before you even start managing risk.

The fix: Automated healthcare workflows that embed compliance into daily operations. One hospital system reduced compliance documentation time by 75% by making it part of the work, not extra work. We have worked with healthcare operations teams managing 87,000+ policy documents across 29 locations - roughly 3,000 policies per facility - with 40,000 employees needing access. Their previous system had 250 policy managers using spreadsheets to track revisions. The solution was not more software. It was simpler workflows that actually got used.

Financial services: Regulators with microscopes

SEC, FINRA, FDIC, OCC - pick your favorite alphabet soup. One wrong trade report and you are facing seven-figure fines.

Success story: A credit union automated their entire BSA/AML compliance through simple workflows. Suspicious activity reports that took days now generate in hours. Examiner feedback: "Exemplary controls." We have also worked with investment teams managing 500+ deals who needed KYC compliance checks, wire transfer verification, and audit-ready documentation for SEC and LP reporting. They saved 5 hours per deal through automation - that is thousands of hours recovered annually. More importantly, they completed audits ahead of schedule instead of scrambling at the last minute.

Manufacturing: Where safety meets chaos

ISO certifications, OSHA requirements, environmental regulations, quality standards. Plus actual physical risks that can kill people.

Reality: A chemical manufacturer replaced their 400-page safety manual with automated safety workflows. Incidents dropped 60%. Not from new rules - from rules people actually follow. We have seen similar patterns in pharmaceutical manufacturing - teams managing FDA, GMP, and GLP compliance across multiple manufacturing sites needed 13-step vendor cybersecurity reviews just for third-party risk management. The complexity is real. The solution is not more complexity - it is making the right complexity actually work.

Technology: Moving too fast to govern

Your biggest risk deployed to production while you were reading this sentence. Your governance process takes weeks. See the problem?

The answer: Governance at the speed of DevOps. Automated approval chains that move at deployment speed. One SaaS company reduced deployment risk by 80% while actually speeding up releases.

Your next move

You have three options:

Option 1: Keep managing GRC through spreadsheets and prayer. It has worked so far, right? (Narrator: It has not.)

Option 2: Make a massive investment in enterprise GRC software. Spend the next year implementing it. Hope your team does not revolt.

Option 3: Try something different. Automate the actual work instead of buying "GRC." See results in weeks, not years.

If option 3 sounds interesting, maybe we should talk. Not about software features or acronyms, but about making your business run better.

Because at the end of the day, that is what this is really about.

Related questions

What is GRC in simple terms?

GRC is basically how companies stay organized, avoid disasters, and follow rules. Think of it like running a household - you need someone making decisions (governance), insurance for when things go wrong (risk management), and following laws like paying taxes (compliance). Most businesses do all three, just not very well coordinated. That is where GRC comes in - connecting these dots so nothing falls through cracks.

How much does GRC software actually cost?

Here is what vendors will not tell you upfront: Entry-level GRC tools require substantial annual investment. Mid-market platforms demand significant budgets. Enterprise solutions? Massive financial commitment. But that is just software. Add implementation (often equals first-year licensing), training, customization, and ongoing support. Mid-sized companies face major capital requirements. Smaller companies can achieve GRC goals with minimal investment using workflow automation instead.

Why do most GRC implementations fail?

73% fail because companies buy complex software thinking it will fix broken processes. It is like buying a Ferrari when you do not know how to drive. The successful 27% start small, focus on adoption over features, and choose tools people actually want to use. Most failures happen because teams get overwhelmed by complexity and revert to spreadsheets within 6 months.

What is the difference between GRC and just having good processes?

Good processes are isolated - finance has theirs, IT has theirs, legal has theirs. GRC connects them. Without GRC, your cyber risk assessment does not talk to your financial risk planning. Your compliance team does not know what IT just implemented. It is the difference between having ingredients and having a recipe - both necessary, but one makes dinner happen.

Do small companies really need GRC?

Small companies need governance, risk management, and compliance - they just do not need expensive GRC software. A 50-person company can achieve effective GRC through simple workflows and clear processes. The moment you handle sensitive data, face regulatory requirements, or have stakeholders demanding accountability, you need GRC concepts. You just do not need million-dollar platforms to implement them.

How long does GRC implementation really take?

Vendors say 3-6 months. Reality: Enterprise platforms take 12-18 months minimum. Mid-market solutions: 6-12 months. But here is the secret - using workflow automation, companies achieve functioning GRC in 30-90 days. The difference? Complex platforms require wholesale transformation. Simple automation lets you improve incrementally. One works. Guess which.

What are the biggest GRC risks companies miss?

Third-party vendors. Every company obsesses over internal risks while their vendors hold the keys to the kingdom. Target breach came through an HVAC vendor. The other blind spot? Employee turnover. When Sarah from compliance leaves, she takes institutional knowledge. Without proper GRC, that knowledge is gone forever. These risks hide in plain sight because they are not dramatic - until they are.

Can Excel handle GRC management?

Excel can track anything. The question is whether it should. Sure, you can list risks in spreadsheets. But can Excel automatically assign tasks when risks emerge? Send alerts for compliance deadlines? Create audit trails that satisfy regulators? Build real-time dashboards executives actually check? Excel is great for analysis, terrible for operational GRC. It is like using a calculator to run your entire business.

What is the minimum viable GRC setup?

At minimum, you need: Clear decision rights (who approves what), documented top 10 risks with mitigation plans, compliance calendar with automated reminders, and audit trails for critical processes. This can be achieved with basic workflow automation for under $1,000/month. Anything less is not GRC - it is hoping nothing goes wrong.

Should we hire a GRC consultant?

Consultants make sense for two scenarios: You are facing immediate regulatory scrutiny, or you are implementing complex enterprise software. Otherwise, save your money. Most consultants install frameworks you will not maintain and processes you will not follow. Better approach: Start with simple automation, learn what works for your company, then bring in expertise for specific challenges. Consultants should accelerate, not architect, your GRC.

How do you measure GRC success?

Forget metrics like "percent of policies reviewed" or "number of risks documented." Measure what matters: Time from risk identification to mitigation (should drop 50%+). Audit findings (should approach zero). Decision velocity (should double). Compliance labor hours (should halve). If these are not improving, your GRC is just expensive theater.

What is the difference between GRC platforms and workflow automation for GRC?

GRC platforms are like buying a mansion when you need a house. They come with hundreds of features, require extensive customization, and assume you have dedicated staff. Workflow automation is like building exactly the house you need - you automate your actual processes, not some vendor idea of them. One costs millions and takes years. The other costs thousands and takes weeks. Both achieve GRC. Choose wisely.

When should you upgrade from basic to enterprise GRC?

Never upgrade because vendors say you should. Upgrade when: You are managing 100+ critical risks across multiple geographic locations. Regulatory requirements demand specific platform capabilities. M&A activity requires complex integration. You have dedicated GRC staff who need advanced analytics. If these do not apply, "enterprise" GRC is just expensive overkill. Most mid-market companies never need it.

How does AI actually help with GRC?

Despite vendor hype, AI in GRC is mostly pattern recognition and automation. It can flag unusual transactions (useful), predict compliance violations (sometimes useful), and generate reports (marginally useful). It cannot make governance decisions, understand nuanced risks, or navigate complex regulations. AI helps with the mechanical parts of GRC. The strategic parts still need humans. Any vendor claiming their AI "transforms" GRC is selling fiction.

What are early warning signs that your GRC is failing?

Watch for these red flags: The same risks appear on every quarterly report. Compliance tasks always happen at the last minute. Nobody can explain who approves what. Audit prep takes weeks of panic. New regulations surprise you. Different departments have conflicting risk assessments. If you see three or more, your GRC is not working - regardless of how much you spent on it.

How do regulated industries like pharma handle GRC differently?

Pharmaceutical and life sciences teams face requirements most industries never encounter. FDA, GMP, and GLP compliance demand digital signatures with multi-factor authentication, complete audit trails for every change, and validated documentation systems. We have worked with pharma operations teams processing over 1,100 compliance forms annually across multiple manufacturing sites - each form requiring multi-department review and sign-off. The difference is not the software. It is building workflows that make compliance the path of least resistance, not extra work layered on top of real work.

What does third-party vendor risk management actually look like in practice?

Most teams think vendor risk is a one-time checklist. In reality, it is a 13-step process that never ends. You need to track cybersecurity questionnaires, privacy assessments, SOC reports, contractual provisions, and ongoing monitoring - and coordinate all of this between information owners, data stewards, and security teams. One pharmaceutical operations team we worked with had documentation requirements spanning GDPR, HIPAA, PHI, PII, and trade secrets - all for a single vendor relationship. The question is not whether you have a vendor risk process. It is whether that process actually runs without heroic manual effort.

Ready to streamline your workflows?

See how Tallyfy makes workflow management simple and effective for teams of all sizes.

About the Author

Amit is the CEO of Tallyfy. He is a workflow expert and specializes in process automation and the next generation of business process management in the post-flowchart age. He has decades of consulting experience in task and workflow automation, continuous improvement (all the flavors) and AI-driven workflows for small and large companies. Amit did a Computer Science degree at the University of Bath and moved from the UK to St. Louis, MO in 2014. He loves watching American robins and their nesting behaviors!

Follow Amit on his website, LinkedIn, Facebook, Reddit, X (Twitter) or YouTube.