What are SAFE notes and a Crowd SAFE for early stage investors?

Learn more about SAFE (Simple Agreement for Equity) notes as well as Crowd SAFE notes - whether you are an entrepreneur or an early-stage investor looking for returns from startups.

Summary

- SAFE notes avoid convertible note complexity - Y Combinator created Simple Agreement for Future Equity without interest accrual or maturity dates, simplifying seed round fundraising

- Crowd SAFE enables non-accredited investors - Unlike traditional private investing, JOBS Act 2012 opened crowdfunding to investors below $1M net worth or $200K income requirements

- Business survival rate is 33% after 10 years - SAFEs can lose all value without IPO or acquisition, requiring 8-10 year time horizon and high risk tolerance from investors

- Four SAFE types based on terms - Cap no discount, discount no cap, cap and discount, or MFN (Most Favored Nations) with no cap or discount. Need help scaling your startup?

This is a guest post on Tallyfy by Jacob Severn about SAFE notes.

Jacob Severn is a certified scrum product owner who specializes in product strategy. Jake’s passion for writing is to make complex subjects easier to digest. He also writes poetry on the side. Please reach him at jacobsevern.com

What is a SAFE note?

A story about dreams, dollars and … funding

This story is for informational purposes only. This article doesn’t constitute legal advice. Don’t forget to consult a legal professional when considering how to raise money.

Marisa and Kyle were both business majors at the University of Iowa when they conceived of their small business idea: an app that provided ratings for various meetups at their college. They later realized the idea could apply to meetups everywhere!

Kyle helped build a minimum viable product and a landing page with a sign-up for the website. Within a few days and some targeted ad spending on Facebook and Instagram, Rate-It.com had 500 people interested!

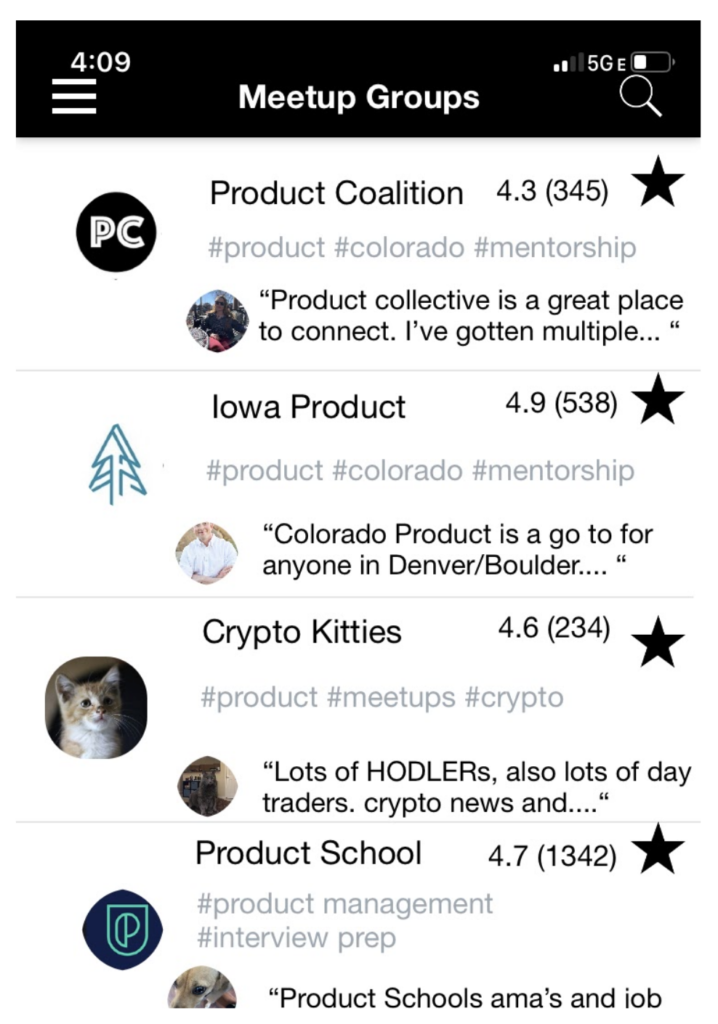

Image Showing Rate-It.com’s Meetup Groups

Marisa conducted some research, and found 5 ways to raise capital for a business.

| Bootstrap | Funded by Marisa and Kyle by eating Ramen and scrounging change from every couch they see |

| Equity and Reward Crowdfunding - i.e. SAFE notes, Crowd SAFE, Convertible Note/debt, Common or preferred shares through Reg A+, KISS | Funded by other people who like the product vision |

| Small business loan, Credit cards | Must have some good business already, high interest rates |

| Friends and Family | Investment from one’s network of friends and family, similar to angel funding |

| Angel Investor, Venture Capitalists | Difficult to attain |

The case for crowdfunding

Marisa and Kyle began to compare and contrast the various funding vehicles out there to see what they should do to scale. They decided off the bat that friends and family, small business loans, credit cards, and bootstrapping were not ideal.

Venture capitalists and angel investors seemed feasible, but not for their initial seed round funding since they needed to scale quickly over a very short time period. They liked the idea of crowdfunding for their initial fund. They needed to find investors, and they wanted them to be dedicated and highly interested in the project.

The initial funds would also enable the business to get off the ground in order to create a more compelling story for the larger investment rounds asked of VCs and angel investors. Before we go further with Marisa and Kyles’ story, we will dive into some definitions.

We will start by defining who accredited and non-accredited investors are. Later, we will dig into what crowdfunding is, and ultimately how various crowdfunding mechanisms work.

What is private investing?

For the longest time, private investing for the average American was limited to companies publicly listed on a stock exchange like the NYSE (New York Stock Exchange). What is the difference between accredited and non-accredited investors anyways?

In order to be an accredited investor, you must either have a net worth $1 million or make at least $200,000 per year (Rule 501 of Regulation D of the U.S. Securities and Exchange Commission). If you don’t meet either of these requirements, you would be classified as a non-accredited investor.

In order to make a private company publicly available on the NYSE, for example, the company must undergo an IPO (Initial Public Offering). Before the IPO, the total share amount and price/share must be determined.

This occurs through an evaluation of the company’s health through profit, loss, growth, and other key metrics. Typically, this work is done by 3rd-party investment bankers, lawyers, and other teams. Once all parties have come to an agreement and a date has been decided, all available shares at the IPO price are listed on the exchange.

Historically, this was the only way for non-accredited investors to privately invest. This restriction was due to the Securities Act of 1933, which was intended to keep investors from putting money into investment vehicles which they did not have the experience or skillset to evaluate.

How crowdfunding works

The Jumpstart Our Business Startups (JOBS) Act of 2012 changed the investing environment, by opening up pre-public investment opportunities to non-accredited investors. This includes opportunities for crowdfunding - a term that means raising small amounts of money from large amounts of people (for example, Kickstarter).

Historically, investors from Crowdfunding opportunities typically received an early-adopter incentive from limited-edition apparel to major discounts. One key thing to note is that Crowdfunding investing may or may not include ownership in the company. The four types of crowdfunding are:

- Rewards-based (Kickstarter, Indiegogo). Individual people donate as much or little as they want, and in return receive some sort of reward.

- Donation-based (GoFundMe, DonorsChoose). Individual people donate as much or little as they want to the cause they choose to support.

- Debt Crowdfunding (P2P Loans - LendingClub, Prosper). Individual people loan out money with an expectation of a return on investment once the loan is paid back.

- Equity Crowdfunding (Republic, SeedInvest, WeFunder, StartEngine). Individuals buy a piece of a company, with the expectation that its value will increase as the company succeeds. This category is often where you find SAFE notes

What is SAFE and why does it matter

SAFE (Simple Agreement for Future Equity) is an instrument for startup equity crowdfunding introduced by startup incubator Y Combinator. SAFEs came about in 2013 as a way to raise money for a seed round.

The predecessor to SAFE notes was the convertible note. Convertible notes are a form of Debt Crowdfunding where an investor loans money to a company which converts into equity plus interest once certain conditions are met. Companies sometimes prefer SAFEs to convertible notes because they lack interest accrual and a maturity date upon which the note converts to equity.

There’s still an ongoing debate in investment communities over whether SAFEs or Convertible Notes is the better instrument. It depends on your situation. The terms outlined in a SAFE note agreement typically consist of these basic items:

- Minimum investment amount

- Valuation cap

- Whether the SAFE is offered at a discount or not (there can be additional perks or considerations depending on how the company wants to carry out the investing round).

The four types of post-money SAFE notes center on these components discussed above:

- Cap, no discount (valuation cap, no discount on equity)

- Discount, no cap (discount on equity, no valuation cap)

- Cap and discount (valuation cap and equity discount)

- MFN (Most Favored Nations); no cap, no discount. This type allows the investor to switch to the terms of the next fundraising round if it is more favorable for them.

The post-money SAFE note structure allows founders to more easily see what percentage of the company they have sold. It also allows investors to more easily predict the stock’s future value.

Equity itself is complicated, as the future value company is impossible to quantify. Also, owning equity is no guarantee of monetary value, and usually comes at high risk to the investor. Equity, convertible notes, and SAFEs are all largely illiquid and not easily converted into cash like stocks are.

The time horizon for these investment vehicles is probably 8-10 years, with a business survival rate of 33% after 10 years. If there’s no IPO or acquisition, SAFEs can lose all of their value.

Advantages

The advantages of SAFEs include:

- Simple to draft

- Not as expensive as filing an IPO

Disadvantages

The disadvantages of SAFEs include:

- Stand-alone agreements. Companies can issue different SAFEs to investors, creating room for “bad actors” (deceptive companies) and confusion when converting SAFEs to equity. SAFEs also require coordination with each SAFE holder, which can be complicated and time-consuming.

- Multiple valuation caps. Different SAFEs can be issued at different values, creating confusion upon conversion to equity.

- Pro-rata investment rights. If structured improperly, SAFEs can allow for confusion on investors’ rights to invest additional money in the future.

- SAFEs are not clearly legally defined as being debt or equity, which can be confusing for tax considerations.

Crowd SAFE notes

Crowd SAFE notes came about as a legal way to enable non-accredited investors to invest in crowdfunding opportunities. These notes can be converted into stock or cash in the future upon acquisition or an initial public offering.

Crowd SAFEs differ from a SAFE by only having two triggers for conversion into equity/stock. They also capture the valuation of the company prior to the crowdfunding raise. Some Crowd SAFEs have terms which are unfavorable to investors, and would allow companies to buy back all of their issued SAFEs at the original cost, instead of paying out the increased value.

This why the SEC is considering removing or changing them as a fundraising option - see an overview here.

Additional crowdfunding opportunities

KISS (Keep It Simple Security) convertible notes

KISS notes are iterations of SAFE notes. There are two versions: one which is similar to a convertible note because there is a maturity date (18 months) and a guaranteed version that offers a certain conversion value in equity.

The second converts to equity and does not have a guaranteed interest rate or maturity dates. All KISS contain an MFN clause. KISS noted usually have a minimum financing round of $1 million, and convert to equity at that value.

If there is a sale of the company prior to equity conversion, the investor can choose to receive a multiple of their investment or convert at the valuation cap or assigned value, similar to a SAFE note. Unlike with SAFE notes, one can transfer SAFE notes to anyone, anytime.

Reg A

“Regulation A (Reg A) allows small and medium-sized companies to raise large amounts of capital without the burden of full Securities and Exchange Commission (“SEC”) registration. Considered a “mini-IPO,” Reg A essentially exempts public offerings conducted by private companies. Reg A, often referred to as Regulation A+ (“Reg A+”) after the amendments mandated by Title IV of the JOBS Act, provides for two tiers of offerings, Tier 1 and Tier 2 (collectively, the “Tiers”), each containing different qualification requirements.” Obtained from Vela Wood Law, based in Dallas TX.

Reg D

Regulation D of the Securities and Exchange Commission is similar to Reg A+; but is only open to accredited investors. Reg D is typically offered under two rules, 506(b) private placements (no general solicitation), and 506(c).

One can do these using portals such as Wefunder. It is much less burdensome on the startup and requires far fewer disclosures, so it is much easier and cheaper for the issuers. Please check SEC’s small business exemption offerings here.

Comparison at a glance

| CON. NOTE | SAFE | CROWDSAFE | KISS | REG A+ | REG D | |

| Discount | Optional | Optional | Optional | Y | Optional | Optional |

| Valuation Cap | Optional | Optional | Optional | Y | Y | Optional |

| Interest | Y | Optional | N | Optional | N | N |

| Acquisition Premium | Optional | 1X | N | 2X | N | N |

| Optional Conversion at Maturity | Optional | N | N | N | N | N |

| Optional Conversion at Acquisition | Y | Y | Y | Y | N | N |

| Most Favored Nation | Y | N | N | Y | N | N |

| Publicly Reported | Optional | Optional | Optional | Optional | Y | Y |

Y: Yes, N: No

Pros and cons

| Funding Vehicles | PROS | CONS | ||

| CONV NOTE | Guaranteed rate of return (investor) | Less configurable (business) | ||

| SAFE | Configurable Terms (business) | No guarantee of return (investor) | Less leverage (investor) | |

| CROWD SAFE | Configurable Terms (business) | Autonomy (business) | No guarantee of return (investor) | Less leverage (investor) |

| KISS | Configurable Terms(business) | Guaranteed rate of return (investor) | Less leverage (business) | |

| REG A+ | Publicly Reported (investor/business) | Autonomy (business) | No guarantee of return (investor) | Publicly reported (business) |

| REG D | Publicly Reported (investor/business) | No guarantee of return (investor) | Publicly reported (business) |

Many startups pick Crowd SAFEs and SAFE notes

After conducting research into the opportunities and alternatives for raising money, Marisa and Kyle went with offering a Crowd SAFE. With a little luck and a lot of hard work, they will solve a real problem and build a supportive investor community!

Tallyfy did this too. Republic.co is an early-stage fundraising platform designed for accredited and non-accredited investors alike created the Crowd SAFE. Note that one big advantage of the Crowd SAFE is that it also serves as a great opportunity to market your company.

From Tallyfy’s experience with crowdfunding, one unexpected benefit was that early investors became some of our most engaged product advocates - they had skin in the game and genuinely wanted to see the product succeed. Early customers love being early investors too!

Manage investor relations with structured workflows

More links and references

SAFE notes - https://www.ycombinator.com/documents/ KISS notes - https://500.co/kiss/ Crowd SAFE notes - https://republic.co/learn/investors/crowdsafe Reg A+ - https://www.startengine.com/seedinvest and https://sec.gov/oiea/investor-alerts-bulletins/ib_regulationa.html Reg D - https://www.investor.gov/introduction-investing/investing-basics/glossary/rule-506-regulation-d Startup Failure Rates - https://link.medium.com/ejSkD6WMy4 If you are reading this post - chances are you are …

- A founder or involved in a startup that needs to scale. If you are thinking about raising money - we advise you think about scaling your operations using Tallyfy. Feedback we have received from other founders suggests that demonstrating operational maturity through documented, repeatable processes significantly improves investor confidence.

- An early-stage investor. We have done both SAFE notes and Crowd SAFEs at Tallyfy.

- An interested party for other reasons.

We hope you enjoyed reading this post!

About the Author

Amit is the CEO of Tallyfy. He is a workflow expert and specializes in process automation and the next generation of business process management in the post-flowchart age. He has decades of consulting experience in task and workflow automation, continuous improvement (all the flavors) and AI-driven workflows for small and large companies. Amit did a Computer Science degree at the University of Bath and moved from the UK to St. Louis, MO in 2014. He loves watching American robins and their nesting behaviors!

Follow Amit on his website, LinkedIn, Facebook, Reddit, X (Twitter) or YouTube.

Automate your workflows with Tallyfy

Stop chasing status updates. Track and automate your processes in one place.