Whether you’re starting a new business or trying to grow one, the accounting department in your company is essential to your success. It can also cause you endless troubles and woes. This department tackles two major jobs for your business, accounts payable and accounts receivable. Of these two, accounts receivable is the fun part of owning a company.

Accounts receivable is the money that is owed to your company. This owed money mostly comes from goods and services that you’ve sold to your customers. Of course, it’s not enough to have open accounts receivable. The money has to arrive to cover the amounts owed and get correctly processed.

Hiring competent staff members for your accounting department is the first step to ensure that your accounts receivable come in and get applied where they are needed. Of course, there are some common mistakes made in this area that you can try and avoid. Here are a few of the most common accounts receivable mistakes.

Credit in Accounts Receivable

When you first open a business or attempt a growth spurt, it seems really easy to extend credit to all of your customers and boost sales. This can be an accounts receivable nightmare. Not all of your customers are going to be as good about paying their debts as you need them to be. In some cases, your accounts receivable department might waste hours trying to get payments, only to have them arrive late or not at all.

To keep your accounts receivable department running smoothly, be very careful about who you extend credit to. This might mean that some of your orders are smaller since the customer needs to pre-pay it, but in the long run, it’s worth the caution. Let your customers build credit with you slowly and restrict anyone who takes advantage of the payment arrangements.

The other credit mistake that businesses commonly make is not running a credit check on all of their customers. Just because your mom’s best friend’s uncle runs the company doesn’t mean that it pays its bills on time. Running a credit check helps your accounts receivable department get a complete picture of the other company’s financial health before offering credit terms.

Ask your accounts receivable staff to run credit checks on each new customer and use a rating system to determine if opening an account is appropriate. Also, you need processes in place to determine how much credit to offer and extend larger amounts of credit as the company meets the terms of the credit account.

Not Offering Online Payments

Who loves writing a check, sticking it in an envelope, buying a stamp and mailing a payment? The answer is not many people. In our digital world where customers shop online, they need a way to pay online as well. Your accounts receivable department needs to offer an easy way for customers to access their open invoices to see detailed information and then a way to pay them online as well.

With an online payment system in place, your company’s accounts receivable department might find that they receive fewer phone calls with questions about invoices and payments made earlier than when they only accepted paper checks and credit card payments by phone. Of course, your account receivable department needs processes in place to update the software between the office and online payment system to keep the information accurate and up-to-date.

A Penalty System for Late Payments In Accounts Receivable

It happens to all businesses at some point. For whatever reason, a company makes a late payment. The cause can be anything from a cash flow issue to turn over in their accounting department. However, if your accounts receivable doesn’t have a penalty system in place for late payments, then you’ll find them making late payments more often. In some cases, you may want to overlook late payments for a steady client who contacts your accounts receivable staff in advance of an issue.

This penalty system created by your accounts receivable team can be anything from a late fee charge to cut off their credit until payments are made in full. In extreme circumstances, you may need to terminate their ability to use credit with your company and stick with a pay-as-you-go policy. You need to decide on an account receivable policy for dealing with late payers.

Another option to encourage payments is to offer incentives for paying off outstanding invoices early. Your accounts receivable staff can reach out to larger clients and offer them a small percentage off of their total invoice if the company pays early. No matter what decisions you make, the goal is always to keep your accounts receivable flowing

Not Keeping the Lines of Communication Open

Sometimes improving the success rate of your accounts receivable department is a simple matter of improving communication. This can be anything from reaching out to a customer to improving communication within the office.

In some cases, the customer’s accounting department might not be as effective as your company’s staff. A payment date might slip by without them realizing that they needed to send a payment. It might be a simple case that they had a question about an invoice, put the invoice in a file to call about it later, and promptly forgot about it. You need your accounts receivable department to have open lines of communication with all of your customers.

Another area of communication errors can occur within your own accounts receivable department. If a customer calls in with questions or to make arrangements for an invoice, it’s easy for one member of the team to know about and others not. You don’t want your accounts receivable department calling a customer who’s already talked to someone else in the same department. It reflects poorly on your business.

Taking a Peek From Time-to-time at Your Customer’s Financial Health

It’s possible that even if you run a credit check before opening an account for your customer, they might experience financial difficulties down the road. You can have your accounts receivable department run credit checks on current customers occasionally. However, this can get expensive if you have a lot of large customers with credit accounts.

You need to have your accounts receivable department run a report to look at each customer’s long-term behavior with things, such as order sizes and payments, to see if there are any red flags. There is risk management software available that can analyze each of your customers to find any potential problems.

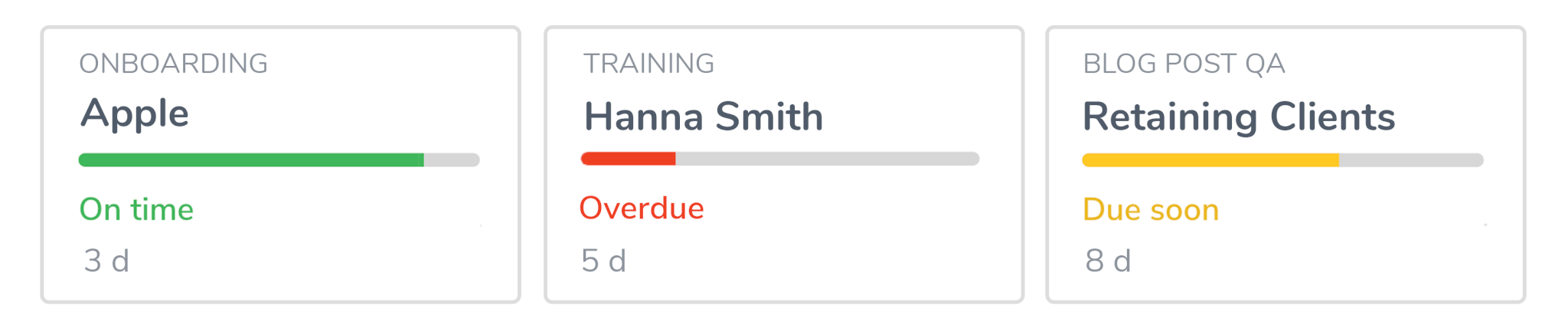

At Tallyfy, we know how important it is to have your accounts receivable department running smoothly. It’s the lifeblood of your company and helps you grow as needed. With our program, you can create your own process for accounts receivable in just a few minutes. You can organize the process to include multiple employees or restrict it to only essential staff in your accounting department.

As part of our program, your company can allow your customers to access certain steps in the process that make it easier for you to get a clear picture of your accounts receivable at any given moment. Please feel free to watch our short video or contact us directly to learn more about how streamlining your processes benefits not only your accounts receivable but most departments in your company.

Auto-document and track workflows with other people in real-time