One of the things that make your company successful is your ability to pay your bills and pay them on time. In the accounting world, the money that your company owes to others is called accounts payable. These accounts payable can be for materials that you’ve ordered, inventory that you’ve stocked, rent that you owe, utility bills that have accumulated and many other items.

Price is what you pay. Value is what you get.Warren Buffett

You want to make sure that you have money flowing into your company, but you also want to make sure that when needed, it flows out to pay your creditors. Keeping your accounts payable under control is essential to your company’s reputation and long-term financial health. If you can’t get the materials you need to make stock, then your company is pretty much dead in the water. This makes paying your bills in full in a timely manner essential to your success. Here are a few common accounts payable mistakes to avoid.

Entering Invoices in a Batch of Accounts Payable

When your accounting department needs to enter a handful of invoices into your accounting software, it seems like it would be easiest to enter all of them in a single batch. Certainly, this takes a lot less time and hassle. However, it can create problems and issues later on.

To make sure that you have a detailed paper trail if your company is ever audited for any reason, you need to enter each invoice into the system one at a time. As you enter these invoices one at a time in your accounts payable system, you’re creating a paper trail, avoiding any attempts at fraud and ensuring that you have a clear and accurate financial picture of your company at any given time.

If you need to look at your financial picture or what that picture was a year ago compared to now, you need to have your accounts payable records in a nice neat order. Entering the invoices one at a time instead of in a batch is the best way to do that.

Making a Copy of an Invoice

You don’t want your accounts payable department to make a payment based off of a photocopy. From the point that a request of payment arrives at your office and the time that a payment is made, there are things that can change and affect the final amount owed.

For instance, you receive a bill for a lot of buttons that your company needed to make its new line of skirts. It was discovered that a third of the buttons were broken. After being contacted, your creditor issued a credit for the damaged buttons to apply to your invoice.

If you’ve made a photocopy of the original invoice, then you run the chance that someone might pay the higher amount. Even more daunting is the chance that someone might pay the bill a second time. This makes it essential to never make a photocopy of an invoice arriving at your accounts payable department.

One Man, Many Hats in Accounts Payable

When you’re first starting out or trying to cut down on expenses, it might be easy to think that you can have a single employee tackle all the accounts payable duties and other jobs. This is a mistake for several reasons.

A single over-worked stressed out person paying your company’s bills is more likely to make a mistake then when a team works on the accounts. Also, it gives that single a lot of power over your company’s financials and reputation.

If you only have a single person paying the bills and that person has too many other job duties to tackle, then it’s easy to see how some responsibilities can get missed. You don’t want to create a situation where bills just sit unpaid because the person paying the bills is doing other things. Creating a dedicated team to handle your accounts payable ensures that they get the attention that they deserve.

Forgetting to Close a Purchase Order

Most of the accounts payable in your office come from purchases of goods, materials or services. To keep up with things that have been ordered and things that need to get ordered, you probably use purchase orders.

After receiving the goods and an invoice, your company cuts a check for payment. At this point, it’s essential that your accounting department closes the purchase order. It has finished its cycle.

If you don’t close the purchase order, you run the chance of issuing a payment more than once. You don’t want to have to rely on your suppliers to let you know that you’ve paid twice. This could create an embarrassing and possibly awkward situation.

Making Late Payments

You want to make sure that all of your accounts payable commitments are being met on time and in full. There are many reasons that your company might end up making late payments. If a bill gets misfiled, entered into the accounting software incorrectly, the accounting team experiences turn over or you just don’t have the money, then the payment might go out later than expected.

All of the companies that you work with will send you either a paper invoice or an electronic one. These invoices usually list the expected pay by date or how many days that you have to pay from the receipt of the invoice. If the time is too short, you need to have your accounts payable person contact their account receivable person to find a solution that benefits both companies.

Not paying your accounts payable on time can affect your credit standing with that company and others for years to come. You don’t want to end up in a situation where you can’t get the raw materials or inventory that you need to run your business. Paying your bills on time is the single most important job of your accounts payable department.

Failing to Communicate

This failure to communicate can occur between your company and your supplier or between the team members in the accounts payable department. Many times a supplier will have their accounting department call and verify the receipt of an invoice. In some cases, the company just wants to ensure that your company is making payments on schedule. It’s easy to misunderstand the reason for this call.

The communication failure occurs in your own office for a variety of reasons. If you don’t have procedures in place, it’s possible that your accounts payable staff doesn’t know what one person is doing and doubles up work or drops the ball entirely. You don’t want to find out that one of your suppliers went months without receiving payment of an invoice because everyone in your accounting department thought someone else had already taken care of it. Communication is key to the success of any business.

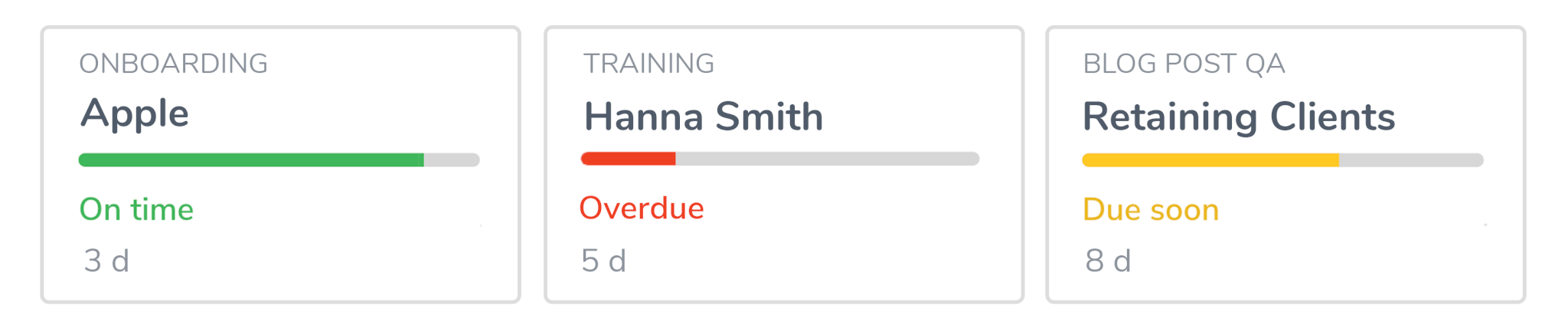

Tallyfy offers a program that helps your company create an accounts payable process that works. You can set up the necessary workflow in minutes. This program allows your employees to work together and see exactly where each invoice is at in the process. Stop worrying about mistakes that your accounts payable department might make by giving them the tools to avoid those mistakes from the start. Contact us today to learn more or get started online today.

Auto-document and track workflows with other people in real-time